Cheapest Sector Strategy

2022 Asset Allocation Review

We’ve heard for eons that “Low bond yields justify high equity valuations.” Value-conscious investors might have described this conundrum another way: “Low future returns in one asset class justify low future returns in another.” (Mysteriously, only the first rendition became a CNBC catch-phrase.)

Cheapest Sector Track Record

With the 2020 Bridesmaid Asset Class (Small Caps) and Bridesmaid Sector (Consumer Discretionary) underperforming in 2021, the Cheapest Sector results in 2021 salvaged a bit of pride for the author of this annual evaluation. Even better, owners of the Financials sector won’t need to send the government its share of their long-term capital gains, since they’ll be holding it for another twelve months.

A Good Year For Cheapskates

For our more fundamentally-oriented readers who are repulsed by all this talk of momentum, we have an alternative. Just forget about performance and focus solely on value!

Low P/E Track Record

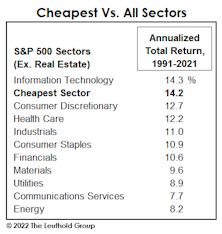

Financials was the “cheapest sector” in each of the last three years, and its significant underperformance versus the S&P 500 has shaved the historical “alpha” from this strategy. Still, those souls who’ve had the stomach to own the Low P/E sector each year have beaten the S&P 500 by 2.9% per annum since 1991.

Low P/E Track Record

The “robustness” of the “Cheapest Sector Strategy” concept is illustrated by strong results across all rebalancing frequencies.

Bridesmaid Strategy - Valuations

Momentum strategies aren’t for everyone. Still, contrarians should recognize that buying the prior year’s worst performing sector for a one-year hold has been an underperforming proposition over the long term.