Commentary

Beware The Hot Air...

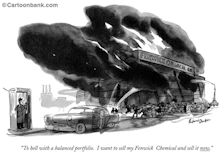

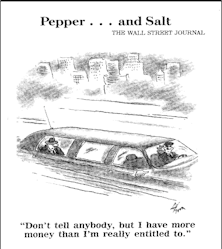

Mask mandates are back in vogue, and it’s investors who should be the first to welcome them: They’ll protect us from January’s blast of “thermal pollution,” when Wall Street prognosticators expel large volumes of hot air with prophesies for the new year. We have no problem with the exercise—so long as full-year forecasts (including one’s own) aren’t taken too seriously. “Forecasts are for show,” Steve Leuthold would always say.

‘Green Book’ Wins Best Picture!

We’re almost at a loss for words! But we want to thank our parents, siblings, extended family, an eighth grade English teacher who doubted us for an entire year, and our golden retriever, Miley.

Negative Feedback?

To summarize (and oversimplify), here are some of the frequent client responses to our prevailing “cautiously bearish” stance:

What A Difference A Year Makes

Early this year we chatted with the retired founder of a Midwest investment management and research firm. After living and breathing markets for six decades, this bearded and iconoclastic character had avoided financial publications, Bloomberg, CNBC, and the like for more than a year.

Special Announcement: James Paulsen, PhD

We are pleased to announce that James Paulsen, PhD, a leading investment strategist whose commentary is widely followed on Wall Street and across the country, has joined The Leuthold Group as our Chief Investment Strategist.

What’s Past Is Prologue

It was thirty-three years ago today that I began my investment career as an equity analyst at The Bankers Life of Iowa (now known as Principal Financial Group). This month, my first as a gainfully employed member of The Leuthold Group’s research team, it seems natural to reflect back as a preface to my new adventure.

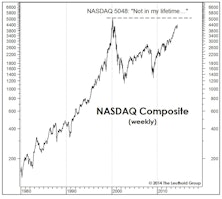

Another Month, Another Milestone?

It’s often said the best bull markets surprise even the bulls, and the current one has certainly done that.

Meet David Kurzman

Continuing our series of introductions of new members of the Leuthold team, this month we present our token New Yorker and bottom up Clean Tech stock picker David Kurzman.

Taking a Different Stance on Hiring; Meet Sr. Analyst, Jun Zhu

Our first introduction is of Jun Zhu, who broke the mold by not being another white Midwestern guy.

Worth Noting... A Scary Top Ten List

Former Morgan Stanley strategist Byron Wein—now at Pequot Capital—publishes an annual list of potential market and economic “surprises” that has become a must read for institutional investors. Along the same lines, Wired magazine listed ten potential threats to what it calls the “Long Boom”. (Warning: This list might make The Leuthold Group look cheerful).

View From The North Country

“Managing Your Mother Lode”—Ten Commandments: outline of Steve’s speech for the Jim Fraser’s Contrary Opinion Forum.

View From The North Country

Will Wall Street See More “Sells”? Expect some changes, but most important development may be a rise in gutsy, independent institutional research. Also, decimalization: an unanticipated bonanza for NYSE specialists.

View From The North Country

“Restrictive Guidelines And Pressure To Outperform”, an excellent article by Walter Cabot appearing in the July/August 1998 Financial Analysts Journal.

Day Trading Frenzy: This Too Shall Pass

In one of our California meetings, the trading frenzy in the Internet stocks came up.

View From the North Country

If you’ve been in this business 30 years you’ll remember Adam Smith’s “The Money Game”. Read it again. Those who never read it, find a copy. Also, the results of our 1998 reader survey and a parody worthy of the “Bawl Street Journal” provides the first totally honest daily stock market report.

View From the North Country

Equity managers increasingly fear the career danger of holding cash. Sagging stock prices have led a growing number high tech firms to reprice employee stock options. The importance of humor and laughter in life and in business.

Worth Noting

New Era investment professionals, crowding onto the money train and a different way to look at the economic impact of bear markets.

Worth Noting and Quoting

Reasonable valuations(?), risk reductions and the wealth effect.

Comparing Public And Professional Stock Market Expectations

85% of mutal fund holders expect the next ten years of stock market performance to match or exceed the last ten years.

View From The North Country

Thermal pollution time...Steve Leuthold offers his 1997 views and 1996 reviews on U.S. stock market, interest rates, economy, etc.

View from the North Country

Excerpts from Leo Melamed’s new book. Former Chairman of the "Merc” (home of S&P futures), gives insider view of 1987 stock market crash. Also, my first annual letter to mutual fund shareholders is reprinted here. You want to know what I really think about the stock market?...Here it is.

View from the North Country

Scarce on Wall Street: “SELL” recommendations. Why? Also, The Great American Weight Gain: How can the typical American really consume so much in a single year?

View From The North Country

A one of a kind prospectus from Buffett, a must read unless you have already seen it.

View From the North Country

Our associates at Weeden & Co. have made the big switch, moving their headquarters and trading center from New York City to Greenwich.

View from the North Country

Gambling fever remains in the heartland. Also, recognizing that times have changed, recognizing that seriousness and sensitivity are on the increase, The Leuthold Group now plans to publish an “abridged” version of this publication. In this “A” version, all non-investment related editorial content and features will be eliminated.

Steven C. Leuthold: Fundamentally Technical

Back in December, Steve Leuthold was interviewed by Thom Hartle, editor of Stocks and Commodities. The following is reprinted from the March 1993 issue of the magazine. Some readers may be surprised to learn the origins of The Leuthold Group were "technical" not fundamental. Some may also be surprised that our "Group leader", an avid student of long term economic and market history, is also a short term trading speculator.

Note: Leuthold's picture is somewhat dated, taken back in the days before the beard turned gray. We believe the color change is the direct result of this commodity trading.

View from the North Country

Polling the Pros on the West Coast…Lottery or Lootery?...Time for “Lean and Mean” In the “Not For Profit” Sector

View from the North Country

Cold Fusion, A Cheap Energy Solution Or Just Fiction?...The Gambling Binge, Some Background And Some Investment Implications...October 1987, Remembered

Answering Your Questions?

A few weeks ago, Alan Abelson, editor of Barron’s, interviewed Steve Leuthold concerning our now cautious attitude towards the U.S. stock market. Alan Abelson asked many of the questions you may have.

View From The North Country

We appreciate your response to our client survey questionnaire. As of February 28th your comments were still coming in.

View from the North Country

In April, polls were taken at the South Florida Financial Analysts Society and at Leuthold Group luncheons in Minneapolis, Chicago, Baltimore and Toronto.

View from the North Country

While the New Zealand stock market did rally 7%-8% in January, it has few friends, not even in those few remaining New Zealand brokerage firms.

View From The North Country

Each January we publish the gold book (Perception II) before this, the green book.

Clarification....

Last month this publication discussed a "New Tax Selling Seasonal Factor" in the stock market resulting from the new mutual fund deadline for tax loss selling being October 31 instead of year end.

View from the North Country

Polling the Financial Analysts Seminar...Welcome Aboard Mike Hamilton...Program Trading And Politics

View from the North Country

In Memory of Ken Smilen...Unreal estate...New Zealand and Australian Market Update...Japanese Market and Copper

We Need More Dean Witters

Last month Dean Witter announced they were getting out of the program trading business. Maybe some other big retail oriented brokerage firms will follow suit. A blowout day on the downside may be all that is needed.

View from the North Country

The Early Warning Work: Have We Found The Keys To The Kingdom?....The Wisdom Of Paul Miller....New Zealand and Australia Updates

“The Boys Are Back in Town"

After the 1987 crash, a goodly portion of the program crowd retired. But now, some 18 months after the debacle, a major part of the program crowd is clearly out of retirement, back in action.