Commodity Stocks

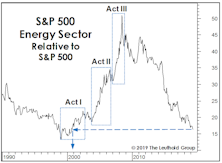

Energy: Still Too Early

Fundamentally, we don’t have much new to say on the disaster that Energy-sector equities have become. Mostly, we want to illustrate the danger of assuming that the stocks of commodity producers will necessarily follow the path of their underlying commodities.

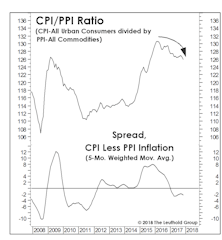

Inflation: Looking Beyond The CPI

The Fed is hell-bent on generating inflation of 2% or higher in an over-supplied world that we think should probably be experiencing mild deflation. Their success or failure at this mission will be critical for asset allocators. For equity managers who must remain fully invested, however, the more important question might be not whether the Fed can generate higher inflation, but where.

Inflation: Not “If,” But “Where”

In the aftermath of the Great Financial Crisis, we reminded investors that it would be historically unusual for the thematic leaders of a bull market to repeat as the winners of the subsequent bull.

Commodity Stocks: “Low” But Not Cheap

A general rule of thumb for thematic equity investors is that the dominant leadership sectors and groups in a given bull market normally don’t repeat as leaders in the subsequent bull.

Commodity Stocks: More Of The Same

Someone forgot to tell commodity trades this is an era of diversity of inclusivity: This year’s leap in the S&P/Goldman Sachs Commodity Index has been entirely the result of its heavily-weighted energy inputs.

Sifting Through The Commodity Carnage

Commodities were the worst performer among the major asset classes during 2018, with the S&P/Goldman Sachs Commodity Index losing 13.8% on a total return basis.

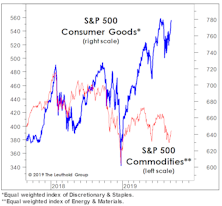

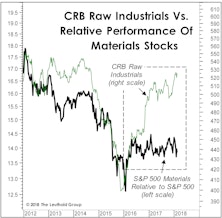

The Commodity Stock Disconnect

We’ve chronicled the ever-expanding gap between commodity prices and commodity-oriented equities. Don’t expect a rebound in one based on the strength of the other. There’s no clear historical tendency for the weaker asset to catch up.

The Commodity Stock Disconnect

While watching a forecast go awry is painful, there’s an alternative that we consider to be even worse: the failure to be paid on an accurate forecast. The resulting feeling of helplessness must be similar to that of a corporate director who manages to lose money on inside information.

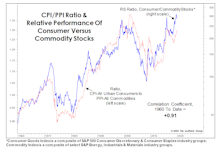

Keep An Eye On “Relative” Inflation

While our Group Selection (GS) framework hasn’t yet warmed up to commodity-oriented industries, our macro work suggests perhaps it should.

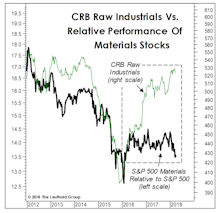

Time For Materials?

The Leuthold Materials sector jumped five spots to #3 in the June Group Selection (GS) rankings, its highest ranking in eight years and the first reading outside of the bottom four in almost four years.

Commodities: Still Worried About Supply

Commodity producers seem to believe that last decade’s commodity boom is set to repeat. This belief itself probably ensures that it won’t.

.jpg?fit=fillmax&w=222&bg=FFFFFF)