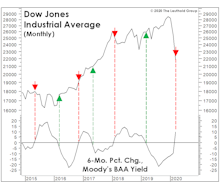

Corporate Bond Yield

Something BAA-d Brewing?

Tightening peaked in Q4-2022, with the BAA yield at 266 bps above its year-earlier level—the most contractionary move since the early 1980s. If the standard lead-time applies, the full impact will be felt in Q4-2023.

Confidence Is The Key

The bull case for a “brief” pandemic-related recession and powerful recovery is the same as the bull case from two months ago for “no recession or bear market” at all: stimulus (as if that’s exactly what the U.S. economy has lacked for the last 11 years).

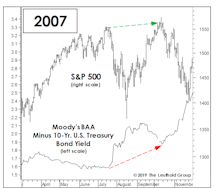

Looking To Credit For Clues

One of the first cautionary signals to emerge during the market’s two-year topping process was the failure of spreads on low grade corporate bonds to return to their early-2018 cycle “tights,” despite last year’s surge to new stock market highs.

The Market Is On Fire… Unless It’s Ice

Yesterday’s S&P 500 new all-time high triggered a few simple internal studies we’ve used to help shape second-half expectations for the stock market.

BAA Yields: The Baaaad And The Good!

Last fall, we repeatedly noted that low grade corporate credits—measured by Moody’s BAA bond yields—were behaving, well, baaadly.

Have We Already Had The Year-End Rally?

In the March Green Book, we discussed the long history of stock market difficulties during mid-term election years. Incredibly, nine of the past 11 cyclical bear market lows have occurred in these years, with eight of those nine recorded during the seasonally-weak months of May through October (Table 1).

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)