Corporate Debt

The Use And Abuse Of Corporate Debt

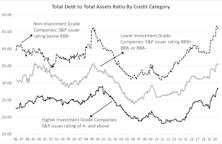

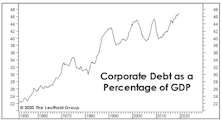

U.S. corporations piled on almost $1 trillion in debt over the first six months of the year (a 10% increase). Corporate debt has now surged to 56% of GDP. We’ve argued that the level of corporate debt isn’t the problem, in and of itself. Rather, it’s what this debt has failed to generate that is the real problem.

Corporate Debt Continues To Pile Up

Public companies are loading up on debt. Since we wrote about this topic over a year ago, a few metrics have reached, or are surpassing, peaks of 1999-2000. When the readings move to extreme levels, we recommend readers take precautions.

A Bear Market In Price, But Not Time

We have a hard time accepting that the excesses associated with an eleven-year bull market and expansion can be fully expunged in 27 trading days, no matter how ugly those days were… keep some powder dry!

It’s Not What They Borrowed, But How They Used It

Following the deflationary bust of 2007-2009, the last decade was expected to be one of deleveraging. Only U.S. consumers appeared to get that memo, however.