Country Rotation Portfolio

Mar

06

2020

Enhancing Country Rotation With Sector Concentrations

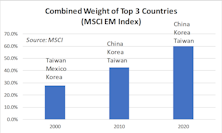

A dramatic shift of country weights within EM indexes has become an inadvertent challenge for a country rotation strategy. Due to this, we tested the integration of a momentum-based sector rotation model to attain exposure to the top-rated sectors to represent the markets of the largest country components instead of seeking to obtain “whole market” exposure.

Mar

07

2019

Sector Concentration And Effects On Country Performance

Is the performance of certain countries mainly driven by particular sectors? And, does U.S. sector performance drive the performance of other countries? (i.e., when U.S. Financials underperform, do foreign countries with large Financials sector weights underperform?). We did some data crunching to address the second question.