Cyclical Bull

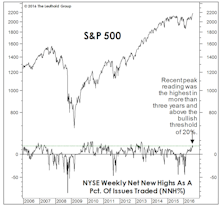

Too Many New Highs To Make A High?

The number of NYSE 52-Week Highs typically peaks during the bull market’s strongest leg, before contracting into the final top. Last month, Net New Highs made a three-year high—implying more upside.

Stick With What’s Working (Until It’s Not)

The year has been especially tough on managers who might have shared our cyclical worries over the stock market, but who’ve elected to stay fully invested via seemingly lower risk value approaches.

A Page For The Bulls

While we have a high level of conviction on our August bear market call, we should emphasize that our disciplines trump opinions.

Value, Momentum, And The Stock Market Cycle

Conventional measures of market action, like breadth and industry leadership, point to the formation of a bull market top. Divergences abound.

Faded Photographs: Obituary Of The Bull Market

How will today’s bull market be viewed through the eventual clarity and objectivity of hindsight? We’ve pulled together several still frames that we think best capture the essence of this historic run.

Canary In The Coal Mine?

The S&P 500 made a cycle high on December 29th, and in early February mounted another assault on that level. Ignoring valuations, the economy, Europe, etc. (not necessarily our recommendation), the most bullish observations we can make about the stock market are: (1) its peak is still recent; and (2) the S&P 500 had significant company at that peak—including the Transportation stocks, Utilities, Russell 2000, S&P 500 Financials, and even the NYSE Daily Advance/Decline. All in all, this action is broad enough that a final top shouldn’t be imminent.

Two For The Price Of One?

Think the bull market is long in the tooth at almost six years of age? Maybe not.

Bulled Over

The Major Trend Index has experienced a bout of instability since April, twice retreating to its Neutral zone before the bull market promptly overrode both signals.

Everyone Gets A Trophy

It’s not just kids’ sports where the achievement bar has been lowered.

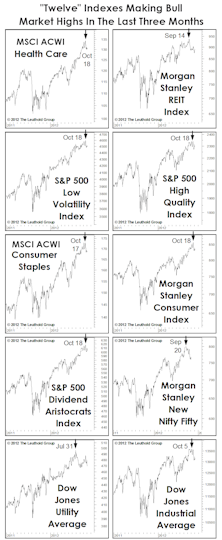

Is The Glass “Half Full”?

A “dozen” major market measures have moved to new bull market highs in the last three months. But many of these have been the groups that do best when “risk” is “off,” and may be a reason “Ain’t Nobody Happy,” even in an up year.

Stock Market Observations

The U.S. bull market is mature and I believe the odds are better than even that 2013 will see a cyclical top.

Ten Charts To Chew On

There are twelve critical indexes (using Big Ten math) that have failed to “confirm” September’s new cyclical bull market highs in the S&P 500 and Dow Jones Industrials.

Technical Glitches

This summer’s rally has taken stocks to the brink of another bull market high, but it has not been an all-inclusive affair. While the NYSE Daily Advance/Decline Line has remained healthy, other technical indicators have not.

An “Old” Bull Market… That Should Get “Older”

The bull market is increasingly showing signs of advanced age, but that is only to be expected for a move that now measures 40 months off its March 2009 low.

MTI Goes Neutral; Next Few Weeks Critical

For now, net equity exposure in both the Core and Asset Allocation Portfolios will remain around 60%, as we wait to see what happens to this analysis in coming weeks.

Does The “Beta Breakdown” Matter?

Significant pull-back in High Beta stocks, but the weakening bid does not necessarily spell the end of the bull market.

It’s Been Better Than It’s “Felt”

The latest bull market has now essentially matched the returns for all bull market recoveries dating back to 1900. Remarkably, it has accomplished this in only half the normal time frame.

Here We Go Again?

Doug Ramsey looks at the history of “severe” market corrections (declines of 12% to 18%), and contrasts that with true bear markets.

Bull Market Milestones: How the Current Bull Stacks Up to Past Cycles

This month’s “Of Special Interest” examines the characteristics of past bull market recoveries. Using a variety of historical comparisons, the current recovery is put into some perspective. The majority of these comparisons seem to indicate the current recovery still has a ways to go.

Despite January, Big Picture Still Bullish

Don’t think we’ve seen a cyclical top, because that would mean everything essentially topped at the same time. Breadth has yet to peak in this cycle and that is one reason we expect the market to move higher over the near term.

The Stampede That Wasn't

A month ago we suspected June might see a big institutional rush into the stock market. The stampede never came, though, and the market finished essentially flat for the month.

Expect Foreign Stocks to Continue to Outperform U.S. Stocks in this Bull Market

Superior performance of foreign stocks of late is likely only the preamble to what the rest of the cyclical bull market will look like.

The Rally Is For Real (And For Earl)

Despite the recent rally, the best two month move since 1933, investors migrating back to bearish camp. This is the best defined “wall of worry” we have seen in over a decade, and one that will provide more fuel for what we believe is a cyclical bull market.

December Market Action

Many of the broad market indexes climbed to new cyclical highs in late-December, confirming that 2007 is almost certain to begin with a bull market still in command.

View From The North Country

Even before Major Trend Index improved to Neutral, Leuthold was getting more bullish. Also, Is the Sun Rising or is it Setting on Japan?

Assessing The Cycle….Putting Today’s Growth Into A Historical Context

Within the current cycle, the stock market recovery is mature, but based on the average post WWII recovery could still have some upside (S&P 500 to 1400?). Currently, earnings growth is well beyond historical averages, but the economic expansion is below the norm.

Third Year Of Bull Market...Now Well Beyond Range Of Typical Bull Market Cycle Peaks

A comparison of the performance of the current stock market recovery to the monthly performance averages of past recoveries (1900 to date).

View From The North Country

In my opinion, the U.S. stock market is entering the terminal phase of the current cyclical bull market, based on our historical studies of typical cyclical bull market duration and magnitude. To a lesser degree the same can be said for the economic expansion.

Third Year Of Bull Market...Assessing The Current Cycle From A Historical Perspective

A comparison of the performance of the current stock market recovery to the monthly performance averages of past recoveries (1900 to date).

Third Year Of Bull Market...Assessing The Current Cycle From Several Perspectives

A comparison of the performance of the current stock market recovery to the monthly performance averages of past recoveries (1900 to date and post-WWII era).

View From The North Country

A special Kate Welling interview with Steve Leuthold. Discussion runs the gambit from Leuthold’s current outlook for the stock/bond markets, to groups he favors, to liquidity concerns, and hedge funds.

Third Year Of Bull Market...Very Late In Cycle, But Still Potential Upside

Stock market now it is third year. Based on the average performance, this may be getting long in the tooth.

Third Year Of Bull Market...Historical Comparisons

A comparison of the performance of the current stock market recovery to the monthly performance averages of past recoveries (1900 to date).

Performance Expectations For Third Year Of Recovery

Based on study of bear market recoveries dating back to 1900, the third year of the recovery is typically not strong. However, this current recovery has lagged the normal recoveries in terms of performance.

February Market Action

Right out of the gates, February’s stock market performance quickly erased the declines posted in January. But by month end, the S&P 500 had given back some of the ground gained in the first half.

Take A Wait And See Attitude For February

February sure came in like a bull, with the S&P 500 already up 1.8% through February 4th, while the NASDAQ has risen 1.1%.

A Look In The Rearview Mirror...The Best And Worst Of Our Research In 2004

This annual exercise is a critical examination of our research effort for the year...presenting both the things we did well and also those things we didn’t do so well.

Getting Later In The Game For The Bull Run

Getting late in the game for the bull run. This is no longer a young bull market, but we continue to believe the market can still move higher from here.

View From The North Country

Continue to conclude the cyclical bull market prevails but my level of conviction is down a few notches. Also, an oil message from the market and “Don’t Be Economic Girlie Men”.