Cyclical

No Longer An Emphatic “NOPE”

While the MTI’s Cyclical category remains hostile at -3, we’ve observed steady improvement in its leading inflation components. Especially notable is the reversal in the NOPE Index (ISM New Orders Minus Price Index).

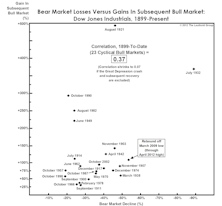

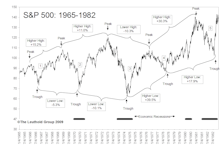

Are You Better Off Than You Were Forty Years Ago?

Old timers will recognize our title as a twist on Ronald Reagan’s clincher in the final 1980 presidential debate with Jimmy Carter.

We recalled Reagan’s line while preparing for today’s 40th anniversary of the great 1982 secular stock-market low. Investors in the S&P 500 have earned an annualized total return of +12.4% since that trough, about two percentage points above the long-term average.

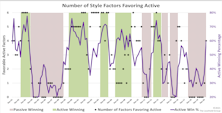

Research Preview: Is “Manager Skill” Cyclical?

The active-passive performance derby is cyclical, determined not by the ebb and flow of portfolio managers’ brilliance but, rather, by market conditions and the slippage that arises from imperfectly comparing funds and benchmarks.

Brick & Mortar Retail Evades October Sell-Off

Although Discretionary stocks broadly underperformed during October’s market decline, prominent amongst the very top industry group performers was a rather unexpected genre of industries—brick & mortar retail. Not only did this cohort hold up during October’s tumult, but many of the underlying stocks have been posting strong returns all year.

Inflation: Just A Cyclical Uptick

We should emphasize that any inflation pickup is likely to be a traditional, late-cycle phenomenon stemming from rising wage growth and rebounding commodity prices. We do not expect a secular move toward significantly higher inflation rates (say, north of 3.0%-3.5%).

EM Leadership: Just The Beginning?

Our EM Allocation Model triggered a BUY at the end of August after 5 1/2-years in bear mode. This upgrade is consistent with a cyclical leadership run of one to four years relative to Developed Markets.

Stick With Strength

The industry price momentum effect - observable in data from the last several decades - has strongly reasserted itself in the last 18-24 months.

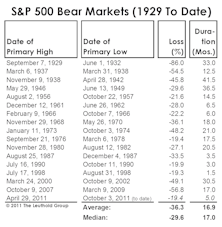

Secular Bull Or Bear?

Is a new secular bull market underway? New highs in essentially all U.S. undermine the argument from the shrinking pool of secular bears. But new converts to the bull thesis should be concerned about the valuation levels already reached.

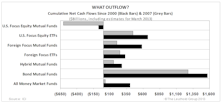

Fund Flows Still Not Quite As They Appear

In this report we take an in-depth look at the evolution of the industry, particularly the U.S. mutual fund industry, to help understand how some fund flow trends are more of an indication of evolving investor preferences instead of an indication of retail investor sentiment toward a particular asset class.

Ain’t Nobody Happy

Despite the big October rebound, Doug Ramsey examines various market players and finds that dissatisfaction with recent market moves may proliferate among all but a select few.

Demise Of Corporate Tax Revenues? A Look At Trends Of Corporate Tax Vs. Individual

This month’s “Of Special Interest” examines Federal tax revenues from corporations versus individuals. Despite strong revenue and earnings growth, corporations paid fewer taxes this year; all of the government’s revenue increase came from individuals.

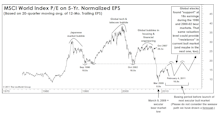

Global Valuations: Reverting To The Trough

From our perspective as disciples of Normalized EPS, the entire bull market to date has come from P/E expansion. However, that stands to change as global Normalized EPS are again on the rise.

Be A Buyer In An October Scare

Following a strong September, October may be a little weaker. However, readers should use any October scare to buy equities in anticipation of strong end to 2009.

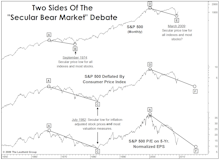

“Secular” Is In The Eye Of The Beholder

Secular versus Cyclical markets. It shouldn’t really matter. Investors can lose a lot waiting to be right. The Key is to focus on the cyclical movements within a secular bull or bear market.

Is Another Major Low Lurking Beyond 2009?

Several independent methods are presented that seem to triangulate on the years 2012 and 2013 as candidates for another significant stock market low - - maybe the final low of a secular bear market which began in 2000?

Is There Any Perspective For Today’s Stock Market?

Eric Bjorgen searches for something beyond The Great Depression or 1990’s Japan. See what he found in this month’s Of Special Interest.

The Importance Of Normalizing Earnings

Earnings are cyclical! This becomes especially obvious near peaks and troughs.