Defensive

Utilities Sector: What’s Driving YTD Performance?

We review the somewhat out-of-character performance of the Utilities sector to try to pinpoint what is influencing results. This article touches on several potential drivers for the sector’s relative strength.

Incongruities In High Quality

Quality is one of the most popular and successful of the equity market’s quant factors. It is intuitively appealing and serves as a useful defensive strategy in falling markets. Low Volatility and Dividend Growth are also defensive factors, while Momentum and High Beta are viewed as aggressive or bullish factors. These offsetting behaviors would seem to make for excellent diversification opportunities in equity portfolios, and for the most part, that is true.

Incongruities In High Quality

Quality is one of the most popular and successful of the smart beta factors. It is intuitively appealing and serves as a useful defensive strategy in market drawdowns.

Not A “Stealth” Decline Any Longer...

The most compelling evidence that a bear market is underway may not be what’s been punished (Transports, Small Caps), but what hasn’t. We believe the final bull market highs of any composite or sector index were recorded on December 29th.

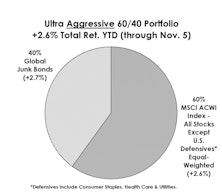

“Fully-Invested Bears” Are The Year’s Big Winners

With the S&P 500 at a double digit gain YTD, one would expect those being rewarded are aggressively positioned. We present two hypothetical portfolios and find the hyper-conservative one has nearly doubled the S&P 500 gain.

A “Quality” Opportunity?

Low quality stocks led out of the past bear market, as typically occurs. Despite being the clear winners from the 2009 lows, it looks like the lower quality stocks can continue to outperform given current valuations and momentum.

View From The North Country

Steve Leuthold’s commentary on how he would structure a defensive portfolio.

Looking For Some Defense?

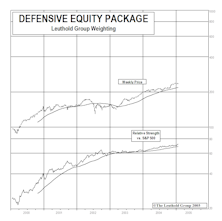

A look at which equity groups have historically held up best during market declines. We revived our “Defensive Equity Group” theme, with individual stocks selected from each of these individual defensive groups.

Building A Defensive Equity Portfolio

Many professional portfolio managers are “equity only” managers, precluded from building up large cash reserves or considering alternative asset classes. Ideas for those who must be fully invested.

September: The Best Month of a Terrible Quarter

September the best month of a terrible quarter. October could present some opportunities.. This could be an exceptional bounce year. Major Trend remains Negative. Recommended strategy: Maintain maximum allowable defensive equity.

November Action: Not Much Positive - Drugs Lead, Golds Trail

The S&P 500 declined 4.0% for the month of November and is now down 1.7% for the year to date.