Diffusion Index

Emerging Markets: Fundamental Diffusion Indicators

Within EM, more robust growth is being exhibited by: 1) firms in Emerging Europe; 2) companies in Energy, Materials, and Financials; and, 3) larger cap companies.

Commodity Diffusion Index Signaling Inflation Pressures Building

Commodity Diffusion Index pointing toward higher inflation. While weak dollar has helped push commodity prices higher, a Diffusion Index converted to a strong currency like the Swiss Franc also is at very high inflationary levels.

Inflation Acceleration Likely In 2011

Commodity Diffusion Index pointing toward higher inflation.

Beware The Economic Ticker Tape

It has become more and more difficult to filter out the short term economic noise. By focusing on this minutia, investors can easily lose sight of the big picture.

Mild Inflation, But No Deflation In 2010

It may feel like a deflationary environment, but the CPI is not likely to end 2010 with a twelve month deflationary reading.

Year End Twelve Month CPI Deflation Reading Unlikely

Looking ahead to 2011, we are keeping a close eye on Housing, Food and Wages, which all could be bottoming out.

Inflation Tame

Looking ahead to 2011, we are keeping a close eye on Housing, Food and Wages, which all could be bottoming out.

Mild CPI Inflation Expected In 2010

The greatest danger in late 2010 and 2011 is monetary debasement inflation, not demand based inflation.

Mild CPI Inflation Expected In 2010

The greatest danger in late 2010 and 2011 is monetary debasement inflation, not demand based inflation.

Mild CPI Inflation Expected In 2010

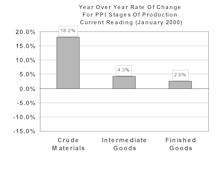

Mild CPI Inflation Expected In 2010 (+3.2%); Higher PPI Inflation (+6.0%)

Weak Dollar Could Continue To Contribute To Higher Commodity Prices

U.S. commodity prices are again trending higher, like they did in 2002, as the U.S. economy recovered. The weak U.S. dollar helped, and recent rally might not last.

Leuthold Commodity Diffusion Index Remains Negative

Like they did in 2002, as the U.S. economy recovered, U.S. commodity prices are again trending higher.

Commodity Diffusion Index Now Signaling Rising Inflation

Commodity Diffusion Index hit 75%, an indication of rising inflation pressures. Moves above 70% in this inflation gauge have served as a pretty good sell signal for stocks.

Mild Inflation Next Twelve Months

This transition from deflation to mild inflation will be a “numbers game” as late 2009 readings are compared against late 2008’s strong deflationary readings, driving the twelve month rate up.

Inflation Outlook: Worrisome

CPI and PPI monthly inflation kicked up a bit with February readings and could do so again when March results are released.

Inflation Still A Potential Threat

Inflation trends are a mixed bag at present.

Commodity Diffusion Index

Falling dollar in recent years has helped drive commodity prices higher. See “Of Special Interest” for a discussion of our Euro Adjusted Commodity Diffusion Index. It is not as inflationary as the Traditional Commodity Diffusion Index, which is now at levels not seen since the late 1970s.

The 2004 Inflation Front

Inflation may prove to be a big surprise in 2004. This month’s “Of Special Interest” highlights several of the monitors we are watching regarding inflation.

Inflation Update…..Consensus View Underestimating Inflation Prospects

Consensus view (2% inflation rate by year end), is underestimating inflation prospects. We forecast 12 month CPI rising to +3.0 to +3.5% by year end. If we are correct, inflation is not fully incorporated into current bond prices.

Inflationary Impact Of The Falling Dollar

Much of the upward price movement in commodity prices, as measured in U.S. dollars, is the result of the weak dollar. A weaker dollar has an inflationary impact on U.S. prices.

Inflation Update: CPI Should Finish 2002 Up 3%

While this higher reading is still far from signaling a significant inflation increase, we do believe that mild upward pressures are building.

Inflation Update...The Diffusion Index

While the higher Commodity Diffusion Index reading is still far from signaling a significant inflation increase, we do believe that mild upward pressures are building.

View From The North Country

Corporate Crime Wave—Not a new era, but exaggerated by length of recent bull market….Why and how some real reform must become reality. Also, why the Federal Deficit is likely to exceed $200 billion.

Leuthold’s Commodity Diffusion Index

The Commodity Diffusion Index is an outstanding inflation monitor and has also been a good gauge of future market performance.

Inflation & Interest Rates

Favorite stock groups now “inflation and interest rate proof”?

View From The North Country

Inflation is on the rise…normal business cycle inflation, not the rebirth of new secular inflation. Also, the stampede of the lambs…the powerbase for the stock market has moved from Wall Street to Main Street.

View From The North Country

Leuthold Group’s Commodity Diffusion Index sell signal now looks like a false alarm. The 1996 budget deficit gap is closing at a faster rate than even Clinton’s administration expected. Have Republicans misread what the majority of Americans want from their political leaders?

Bond Rally Lost Its Punch In March

Weight of the evidence bond market discipline shifted to negative from neutral this month.

Commodity Inflation Appears To Be On the Upswing

Diffusion Index breaks above its 70% danger zone, signaling higher commodity inflation ahead?

Time to Sell Stocks Our Diffusion Index Says

The tool has functioned as a good lead indicator of changes in inflation momentum. When the reading is moving up it is an inflation acceleration alert and a move above 70% is usually cause for a general alarm. On the other hand, readings below 50% are a comfort zone.

Bond Market Summary

Bonds moved higher in August but did not make new highs. However, it is only a matter of time. Most of our inflation work is still cool, but this month we present one of our tools that is mildly disturbing. The commodity spot price diffusion index seems to be on the rise, although not yet in negative territory.

Time to Buy? Diffusion Index Says Yes!

Our weekly work comparing prices of 94 commodities with levels 12 months previous seems to function quite well as a stock market timing device and is also helpful at times with the bond market. At the end of July, it registered a “buy signal” for both. Take a look at this section and see how this has worked out 1973 to date.

All’s Quiet on the Inflation Front (Now What About Deflation?)

At this point there is no indication inflation may be about to accelerate. Some may recall that in the early spring of 1984, this work led us to conclude that 1984 inflation might be a lot lower than most then thought at the time. This section also includes comments on the possibilities of deflation and what might be expected if it does occur. It probably would not be the disaster some seem to think.

Inflation Watch: Mostly Good News, But....

The one-year diffusion index of 90 commodities is indicating a resurgence of inflation may be right around the corner. We think it is wrong. Our other tools don’t confirm. However, the past record of this tool cannot be ignored.