Diversified Metals & Mining

Digging Into Materials

If there are shortages, bottlenecks, and commodity inflation everywhere, why is the rating for the Materials sector so uninspiring? Although valuations are compelling for Materials groups, the overall decline in the rankings can be traced to EPS revisions and macro influences, like the U.S. dollar and low rates.

GS Scores: Industrial Metals Stocks Heating Up

While the Materials sector overall still isn’t looking stellar based on our work, we think with the Metals theme heating up, it’s a trend worth watching.

Diversified Metals & Mining Shine This Week

Internet Software & Services and Diversified Metals & Mining were this week's best groups. Packaged Food & Meats and Advertising were this week's worst groups.

Industry Groups To Avoid

Currently, the Unattractive range of our GS Scores is characterized by two themes, commodity-oriented groups and high dividend groups.

The Dreams & Nightmares Of 2013

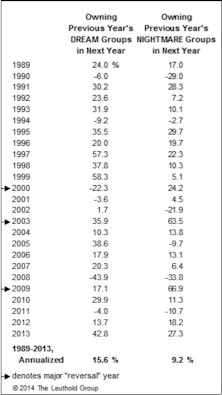

For 25 years we’ve tracked hypothetical industry group portfolios comprised of the previous year’s “Dreams” (20 best performers) and “Nightmares” (20 worst performers).

Diversified Metals & Mining—A Popular Theme Revisited

After an incredible secular rise in both metals & mining stocks and industrial metals prices, which ended in 2008 after nearly a decade of upside, we take a look at where this group stands today.

Adding Aluminum: Initiating Exposure To Materials Sector

Select Industries portfolio has added new equity group holdings in Aluminum, initiating sector exposure in Materials.

Commodity Inflation = OWN MATERIALS STOCKS; Commodity Deflation = OWN MATERIALS STOCKS!!

There remains considerable macro support for industrial commodities.

New Select Industries Group Holding: Adding Diversified Metals & Mining

Ranking in top twenty and making a play on declining dollar and rising inflation.