Donut Portfolio

Cash, not Charles, is Finally King

Diversification has acquitted itself poorly in precisely the type of rough patch its proponents have been hoping for. So have some popular market-timing strategies, unless one has applied them across multiple asset classes.

It’s Been Ugly Across The Board

Aside from a couple specialized approaches, 2022 is shaping up as the second-worst year for “multi-asset” investing since at least 1973. It seems money printing supported more than just the equity subset.

Multi-Asset: Winning By Losing Less

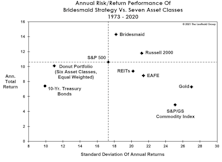

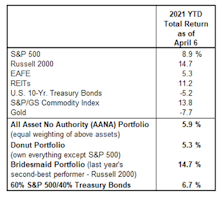

At the beginning of the year, we liked the chances for the “Donut Portfolio” to break its 10-year losing streak against the S&P 500. As a refresher, the Donut holds six of seven key assets in equal weights. The S&P 500 is excluded—a decision probably only suitable for allocators who are self-employed.

“Donuts”—The New Comfort Food

For the last few years, the S&P 500 has been the most richly priced of the broad equity indexes, and its moderate decline, to date, makes it even more so on a “relative” basis. In recognition of that, we began to track the hypothetical allocation strategy of avoiding this index.

The “Donut” Might Be Healthier Than You Think

Lent ended last week, allowing Christians to resume the intake of unhealthy foods. But rather than a nice, thick T-Bone steak, we’d suggest sampling one of the few items that’s fattened investors’ accounts in 2022—the Donut!

The Donut: A Not-So-Healthy Snack

In April, we suggested that an antidote for high valuations on the S&P 500 might be an extra bite or two of the “Donut” Portfolio—an equal-weighed portfolio of several of the usual asset allocation suspects excluding the S&P 500. That proved to be good advice for about two months.

Snack Time?

As discussed elsewhere in this section, we had a novel idea for asset allocators tired of chasing the S&P 500: Hop off the treadmill and take a “Donut” break!

Time For A “Donut” Break?

Despite a resurgence in Small Cap stocks and Commodities, it still feels like an “S&P 500 World” for asset allocators. The financial media remain obsessed with S&P 500 targets, S&P 500 earnings, and S&P 500 stocks. And why wouldn’t they be?

.jpg?fit=fillmax&w=222&bg=FFFFFF)