Drawdown

2020 Earnings And The Extremophile Market

As we wade into the waters of second-quarter earnings, muddied by economic shutdowns and suspended guidance, we thought it might be a good exercise to pull back from the “micro” of firm-level beats and misses and examine the “macro” picture that is the Great Earnings Washout of 2020.

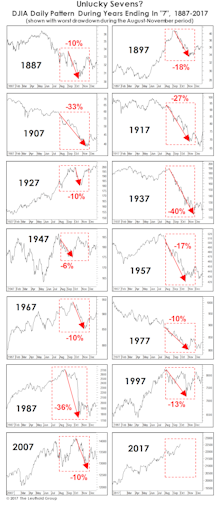

2017 Vs. Other Years Of Market Calm

Record lows in implied volatility (VIX) have been analyzed ad infinitum throughout 2017, but the readings shouldn’t come as any surprise.

Breaking The Pattern?

The Chicago Cubs’ break of the 75-year Billy Goat Curse last year might have warned us of the dangers inherent in historical pattern analysis.

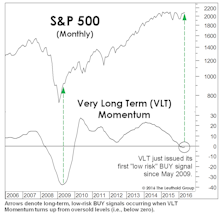

VLT Says “BUY”

Breadth underlying the 4-month upswing has been stronger than that observed during any other rally leg since 2013. Despite just a 14% correction in the S&P 500 from its peak, a new VLT “BUY” signal was triggered. Failed signals are relatively rare, the last one occurred in December 2001.

How Long Can Small Caps Lead?

The Russell 2000 is about five points ahead of Large Caps YTD, and is approaching its April 2011 long-term relative peak. We view this outperformance as their leadership’s last gasp and not a new cycle.

.jpg?fit=fillmax&w=222&bg=FFFFFF)