Earnings

S&P 500 Earnings Waterfall 2Q 2023

This month’s Refresh continues our practice of summarizing the latest earnings season by evaluating the composite results of the S&P 500 member companies. Many analysts address sales and net income, but rarely speak to the middle lines of the income statement.

Excellent Back 9 For Q2 Reporting

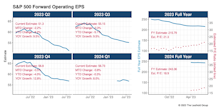

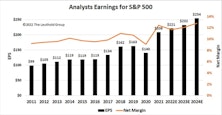

An outstanding second half for Q2-23 earnings pushed the S&P 500 bottom-up EPS estimate from $51.30 to $54.92. Amazon and Nvidia were the two largest contributors to the August surge. With the entire index nearly done reporting, our current EPS estimate will end 11% below its high watermark ($61.56).

Q2—The EPS Slide Resumes

Q2-23 reporting is about halfway complete for firms in the S&P 500. Bottom-up operating EPS estimates for Q2 are once again sliding lower as we wade farther into earnings season. This attrition is not uncommon but it is certainly a break from Q1 announcements, where EPS estimates rose 5% over the course of reporting. Q1’s action was a bullish talking point for many who touted the end of higher-than-normal erosion in forward EPS estimates over the past year. Since peaking in April 2022 at $61.56, Q2’s EPS estimate has shrunk nearly 17% (Chart 1).

Marg-flation

The 2022 bear market will be remembered as a year when collapsing growth stock valuations and rising interest rates doomed almost every asset class to return purgatory. Hopes for avoiding a second down year rest with a potential top in interest rates and solid earnings underpinning the stock market. Wall Street strategists have a year-end 2023 price target of just over 4,000 for the S&P 500, a few percentage points of upside from today but hardly reason to toast a prosperous new year.

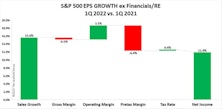

Third Quarter 2022 Earnings Waterfall

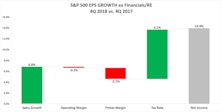

This earnings season has not been free of concern, and profit margins are clearly weakening from last year’s highs. Our earnings waterfall template highlights several themes coming out of third quarter results.

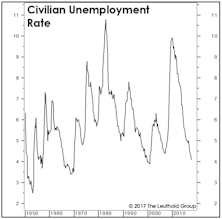

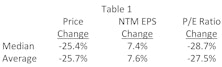

Earnings Expectations: The Bear’s Other Shoe

To paraphrase that great market historian Leo Tolstoy, “each bear market is unhappy in its own way.” Recession, interest rates, valuation bubbles, inflation, war, credit cycles, oil prices, manias & panics: the tipping point that triggers each bear market is always different. However, bearish forces ultimately manifest themselves in just two ways; declining earnings and/or declining valuations. June’s Of Special Interest report detailed how the current bear market has been fueled entirely by collapsing valuations, with the largest P/E compressions occurring in companies with the highest starting valuations.

Margin Pressure Under The Surface?

The spectacular economic rebound from the pandemic lockdown lifted corporate earnings to heights that are almost hard to fathom. That stupendous earnings run has been fueled by rising profit margins, which also reached record highs after the pandemic.

Research Preview: The Impact Of Falling Estimates

The 2022 bear market has been driven entirely by a collapse in P/E ratios. Last month, we noted that the other potential driver of market declines—falling earnings—had yet to raise its ugly head. Now we examine past episodes to consider how the stock market might react when the “other shoe” (EPS) drops.

“PSsss”

The most brutal bear markets occur when falling earnings are accompanied by shrinking valuations, producing a compound negative effect on stock prices. Investors in 2022 have (so far) avoided this double-whammy in that valuations have taken a hit, but EPS estimates are holding strong. We are intrigued by the notion that 2022’s bear market has, to date, been all about valuation compression rather than earnings weakness. Investors are coping with the problems of the day by letting the air out of bubbly valuations, and this report takes a closer look at the valuation squeeze underlying the current selloff.

Research Preview: P/E Multiple Compression In 2022

Stock market corrections are the result of falling valuations and/or falling earnings, and when both conditions appear together, investors are in for a rough ride. Thus far, the 2022 selloff has been confined to compressing P/E ratios, and we launched a research project to take a closer look at shrinking stock valuations in this market downdraft.

Earnings: Reversing The “New Normal?”

If earnings’ nearly vertical ascent continues for another six months, 12-month trailing EPS will intersect the 6.9% long-term-growth trend line connecting the five major EPS peaks between 1974 and 2007. The “New Normal” has given way to the “Good Ol’ Days!”

Hello To The Roaring Thirties?!

The ink hadn’t dried on 2020’s PPP checks when pundits began speculating that the new decade could be a repeat of last century’s “Roaring Twenties.” That’s become a popular view after a booming 5.7% real GDP growth and a nearly 30% stock market gain in 2021. Just how popular? Analysts are already extrapolating their bullish views into the 2030s!

2022 Earnings: Place Your Bets

It’s once again that time of year for what our founder deemed the great “thermal pollution.” Market pundits and prognosticators will divine, guess, and predict all that the market will bring in the new year.

Valuations And The Earnings Recovery

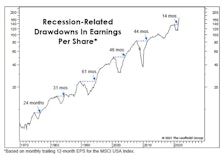

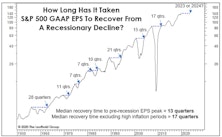

Analysts at Standard & Poor’s will soon confirm what’s been known for several months: The earnings downturn associated with the COVID recession was the shallowest and shortest of any recession-related EPS decline.

The EPS Recovery And "The Cycle"

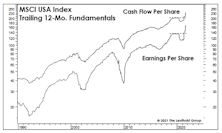

In a couple of weeks, final second quarter EPS for the S&P 500 will confirm the fastest recovery ever from a recession-related earnings decline. That’s old news, and before it has even hit the tape. But we’ve had a sneak peak from the monthly, 12-month trailing EPS numbers published by MSCI for its USA Large Cap Index. Those figures showed that EPS exceeded their pre-COVID peak in May, and the latest reading (through August) is already 22% above the prior high! Simple trendline analysis suggests that EPS for U.S. Large Caps are likely higher today than they would have been in the absence of the COVID pandemic and hyper-stimulative response.

The 2021 EPS Rocket Ship

If you want to see a rocket ship, there’s no need to crane your neck upwards to see the latest exploits of our billionaire space cowboys. Rather, look to our earnings glidepath chart and marvel at the contrails of the 2021 full year operating earnings for the S&P 500.

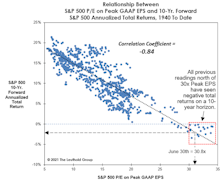

Peak Earnings Yield A Rock-Bottom Forecast

At today’s 30.8x, the Peak P/E stands in the 99th percentile on all time horizons except the “New Era” (1995-to-date). Yet, that’s still five “handles” below the 35.8x all-time high recorded in December 1999. If that figure is matched, the S&P 500 will top 5,000.

The Earnings Recession Is History

We expected that the earnings recovery from the shortest-ever U.S. recession would be the fastest on record. Trailing figures for the MSCI USA Index now confirm this: Trailing EPS and Cash Flow Per Share have surged to new highs only 14 months after their March 2020 peaks.

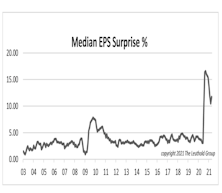

“Surprise” Or “No Surprise?”

Navigating the investment landscape over the past year has been a journey full of surprises. No data other than “earnings surprises” can better demonstrate how unpredictable companies’ financial performance has become.

Valuing The Experiential Reopening

The onset of the COVID-19 pandemic in early 2020 brought a sudden halt to social gatherings, crowd events, and even personal contacts. Experiential business models were hardest hit by forced closures and lockdowns; cruise ships were forbidden to sail, restaurants and theme parks were closed, and air travel and hotel occupancy dwindled, all in an attempt to minimize personal interactions. The stocks of leisure services companies took a beating in March 2020, with Chart 1 documenting the virus’ impact on 34 large and midcap stocks representing this theme.

Research Preview: The Experiential-Reopening Trade

A strong argument can be made that experiential consumer services was the economic sector hardest hit by the pandemic lockdown. Cruise ships were forbidden to sail, restaurants and theme parks were closed, and air travel and hotel occupancy dwindled—all in an attempt to minimize personal/public interaction. The stocks of experiential companies took a beating in March 2020.

Looking Forward To 2021 Earnings

As we turn the page on 2020, a peek ahead to the S&P 500’s 2021 operating earnings is probably in order. You never know, earnings and valuations might be important again one day.

Research Preview: 2021 Earnings Breakdown

Earnings estimates for 2021 are being projected above the records posted in 2018 and 2019. We ask the question, “How do we get there?” Here we present an introduction to this topic that we will examine at length and provide a full analysis in mid-October.

European Banks: Buy Low…?

As steadfast believers that “price paid” is a major determinant of an investment’s risk and return, we snap to attention whenever we hear that an asset is selling at a multi-decade low.

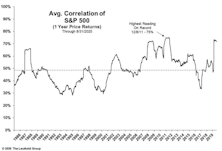

Earnings’ Lost Relevance

One characteristic of recent stock market action is extreme correlation. Chart 1 shows that during the sharp market decline following the COVID-19 arrival in the U.S. and the V-shaped upturn thereafter, the average correlation of S&P 500 constituents moved to near its highest level measured back to 1986.

2020 Earnings And The Extremophile Market

As we wade into the waters of second-quarter earnings, muddied by economic shutdowns and suspended guidance, we thought it might be a good exercise to pull back from the “micro” of firm-level beats and misses and examine the “macro” picture that is the Great Earnings Washout of 2020.

Small Cap Valuations: Zombies And Ragamuffins

Asset allocation decisions are fairly straightforward for groups of profitable and growing companies that fit nicely into a discounted cash flow model, but it is more difficult to describe the valuation of groups that include unprofitable companies.

Mapping Out The Eventual Earnings Recovery

We view the coronavirus pandemic as the final straw that tipped an already vulnerable U.S. economy into recession, rather than the watershed event that will change the way we view growth, profitability, and even the nature of work itself. But even economic “optimists” like us need to recognize that the recovery back to last cycle’s earnings peak will be a long and grinding one. There’s a good chance that the four-quarter trailing S&P 500 GAAP Earnings Per Share cycle peak of $139.47 will not be exceeded until 2023 or 2024 (Chart 1).

Are Earnings Set To “Gap” Higher?

We are troubled that the bullish optimism has spilled over into the 2020 estimates for S&P 500 earnings. Zero growth in 2020 is probably not a bad guess for NIPA figures, but S&P numbers don’t always follow suit.

Giving Up The Ghost

The approach of Halloween brings thoughts of jack-o-lanterns, scary movies, and buckets full of candy. The season also marks the time when investors finally give up the ghost on the optimistic, even wishful, earnings forecasts made early in the year.

So Long Tax Cuts… We Hardly Knew Ye

Our earnings waterfall analysis for the fourth quarter tells a story consistent with the entirety of 2018: earnings growth was fantastic, boosted by the twin drivers of strong sales growth and a lower corporate tax rate. Chart 1 spotlights the quarter’s tally, which produced a healthy sales growth number despite some economic weakening.

2019 Earnings: Don't Bet On 6%

Currently, the collective intelligence of Wall Street is predicting 6% S&P 500 EPS growth in 2019. It’s also the 61-year average annual growth rate for the index, so how wrong could it be?

Earnings Releases Cause Surge In Price Volatility

Three years ago, we did a series of studies looking at price reactions to corporate earnings releases (ER) and we found that, since 2007, price movement has become more dramatic on ER days.

Second Quarter Earnings Waterfall

The S&P 500 reported blockbuster earnings growth again in the second quarter of 2018. With the corporate tax cut boosting profits this year, we were curious to know how much of the improvement was tax driven and how much was due to the exceptionally strong economy.

Cycles And Taxes And GICS, Oh My!

Analyzing quarterly financial results and developing insights about upcoming periods is always difficult, but the first quarter of 2018 was unusually complicated.

Earnings Soar While Liquidity Circles The Drain

Question: How can you be cautious on the stock market with recent earnings results so spectacular?

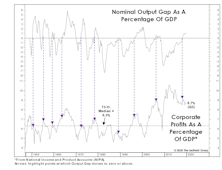

The “Gap” Is Gone. Now What?

In Q3, the CBO’s Nominal Output Gap swung to positive for the first time since the last business cycle peak. This type of move has historically meant the cyclical peak in profit margins is close at hand.

Emerging Markets: Fundamental Diffusion Indicators

Within EM, more robust growth is being exhibited by: 1) firms in Emerging Europe; 2) companies in Energy, Materials, and Financials; and, 3) larger cap companies.

Earnings Momentum

The two-month Up/Down Ratio for Q1 results shows a reading of 1.48. Like the quarter before, an excellent “one-month” figure has been dragged down by a second month’s results.

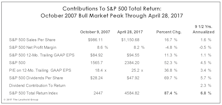

How To (Almost) Double Your Money In Under Ten Years

Buying the S&P 500 on one of the worst possible days in history ultimately yielded a total return of +87.4% (+6.8% annualized) through the end of April 2017...darn, sounds like an advert for Vanguard!

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)