Elections

Midterm Elections—Not A Typical Year

While midterm elections are not typically big market movers, there is really nothing typical about 2022.

An Historical Look At Biden’s “Future”

We’ve read far too much about what Joe Biden and a newly-blue Congress might do in the months ahead, but less so about the conditions Biden and his team inherit. Such “initial conditions” usually have a heavy hand in policy outcomes, market outcomes, and even a president’s legacy.

Election—Another Chance For Value

As we Chinese watch the elegant display of the western democratic process this election season, we can’t help but think there are indeed people less fortunate than us “commies.” Worse yet, some of these people are Value investors.

Stock Market Defies Seasonal Gravity

“That which does not kill us, makes us stronger” might be a good motto for this never-ending bull market. The bull continues to shrug off the effects of both Quantitative Tightening and an escalating trade war, and it’s doing so during a seasonal stretch in which many of its predecessors have sunk to their knees (if not their demise).

Cycles: Bearish Window Closing, Another Opening...

We wrote in May the mid-year months of a mid-term election year are historically the weakest for the stock market from a calendar perspective. Large Caps, however, have mostly bucked that pattern.

Mid-Term Election – Favorable For Stocks

General patterns are a weaker dollar, rising stocks and range-bound bond yields.

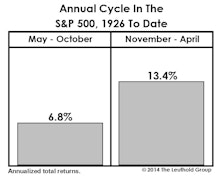

Two Market Anomalies Intact: A Quantitative Review

We are entering the most bearish window among the potential combinations of the Presidential Election Cycle and the Annual Cycle.

Emerging Markets: Dismal 2013, Hopeful 2014

What worked, what didn’t; what you need to consider for investing in Emerging Markets this year.

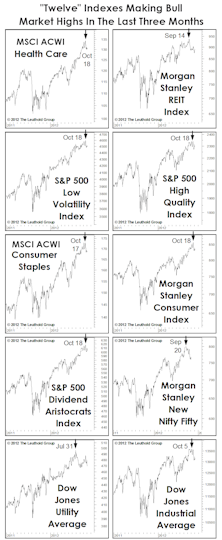

Is The Glass “Half Full”?

A “dozen” major market measures have moved to new bull market highs in the last three months. But many of these have been the groups that do best when “risk” is “off,” and may be a reason “Ain’t Nobody Happy,” even in an up year.

Stock Market Observations

The U.S. bull market is mature and I believe the odds are better than even that 2013 will see a cyclical top.

Major Trend Index Fading As “That Time Of Year” Looms

With “That Time Of Year” approaching and the Major Trend Index not too far above the neutral zone, we review nine factors impacting the stock market from a glass-half-empty perspective.

Presidential Elections And Financial Assets

Does The Market Have A Party Preference In The Presidential Election? Results are a wash, so investors might rethink their assumptions about party affiliation and market performance.

Predictions for 2012…

From the stock market to politics to football, Doug Ramsey offers up ten predictions and thoughts for the New Year…. Even though we’ve already had a one month “peek” at 2012.

The Charts Of The Year

This month’s “Of Special Interest” takes a look back at and updates some our favorite charts from 2010.

So Much For “Red October”

Now that the election is over and QE2 in the works, resist the temptation to “sell the news.” We expect to see the market rally through the end of the year. Sentiment still benign and valuations still attractive.

A Mid-Term Exam: What The Upcoming Elections Could Mean For The Stock Market

Prompted by a client request, Eric Bjorgen examines the impact of mid-term elections on the stock market.

Countering The Consensus Gloom

There’s an overwhelming consensus that the U.S. economy has slipped into a long-term phase of declining growth in real GDP and chronically higher unemployment. Here’s a dissenting opinion from a client, along with Steve Leuthold’s response.

View From The North Country

Leuthold shares summary comments on various subjects, such as Consumer Sentiment, and the dollar, among others. Also, airlines as growth stocks (?) and the 2006 Elections: the Incumbent advantage still dominates.

View From The North Country

Election should be a non-event for stock market. No matter which party gains control of House or Senate, we expect to see two more years of gridlock. Also, still bullish on Industrial Metals and the unusual behavior of U.S. Equity Fund Flows.

Pre- And Post-Election Stock Market Performance

An analysis comparing S&P 500 performance for the current election year to the performance averages of all election cycles since 1944.

View From The North Country

After all the outrage over Enron and other accounting scandals, Congress is now working to over rule the FASB recommendations and guidelines regarding the accounting for options. They have clearly caved to the Tech lobby and their campaign contributions.

Pre- And Post-Election Stock Market Performance

The average gain for the entire 12 month period spanning the pre- and post-election periods is not much different from the average gain in the comparable 12 month period for all years including non-election years.

Pre- And Post-Election Stock Market Performance

Over the past several months, we have been comparing S&P 500 performance for the current election year to the performance averages of all election cycles since 1944.

View From The North Country

Terrorist threats, rising oil prices, the war in Iraq, and upcoming presidential election seem to have taken center stage against a backdrop of impressive corporate earnings momentum.

Pre- And Post-Election Stock Market Performance

Over the past several months, we have been comparing S&P 500 performance for the current election year to the performance averages of all election cycles since 1944.

The "Wait and See" Market

It now seems that the market has settled into a comfort zone— or put differently— a trading range that reflects investors’ current lack of conviction about prospects for the second half of the year.

Market Mood Swings

Bull market still intact, but investor appetite for risk remains subdued. April’s preference was for defensive and conservative strategies. Old axiom “Sell in May and go away” doesn’t seem to apply during the 130 days leading up to election day.

View From the North Country

Bear market or steep correction? Rising inflation could actually be good for equity market over next few years. FASB arrives at a decision which could spell the end to the repricing options practice by making it prohibitively expensive.

Today’s Fiscal Felons and Fiscal Heroes: a 1994 Voting Guide

From Alabama to Wyoming, our Senators and House members are rated for fiscal responsibility based on a study by The Concord Coalition. See how yours rank.

Major Trend Index Shifts to “Negative” In April

On Monday April 6th, The Leuthold Group’s Major Trend Index downshifted from “neutral” status to “negative” status. The prudent course is a move to the sidelines, becoming a spectator for a while.

View from the North Country

The clock is ticking down, but we don’t know when the upside explosion will take place. It might even occur before the 1984 elections. Whatever, the investment rewards will be rich indeed. Should investors really run the risk of being out of the bond market? Really, the downside risk, considering the earning power of the coupons, is probably negligible. But the potential rewards are mouthwatering.

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)