Equity

Bridesmaid Strategy For Equity Managers

Our analysis on the Bridesmaid effect originated back in 2006, but was initially based on equity sectors rather than asset classes.

Duration: It’s Not Just For Bonds Anymore

We measure the sensitivity of common stocks to changes in interest rates using Implied Equity Duration. Growth-oriented sectors tend to have higher duration than Value-oriented sectors, while regional differences are largely explained by interest rate and risk premium differentials.

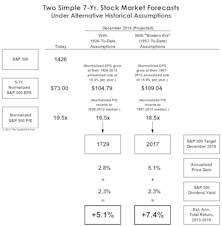

A Peak At The Rear-View Mirror!

We’ve lately made it a January tradition to publish a “Rear View Mirror” forecast for S&P 500 returns out to the end of this decade.

Leuthold Stock Quality Rankings

Our Stock Quality Rankings currently show that stocks with Low Quality rankings outperformed those with High Quality rankings.

Catching Up To The Guy Who Sold At The Market Top

Given various assumed compound rates of return, how long will it take for the investor who remained in stocks to catch the investor who shifted to T-bills at the top?

Sorry, Equity Stance Is Still Cautious

The market’s tone improved significantly in very late January and got even better with the impressive bond motivated upside explosion on Friday February 3.

Scanning The Markets

The table on the next page is a performance rundown for Leuthold equity market sectors (and other measures) ranked by February 1993 performance.

Tuning Up Techniques For 1992

This marks my twentieth year publishing an equity model portfolio with a sector focus.