ETFs

Hot Under The Collar

If uncertainty is the bane of investors everywhere, then the fear of large losses in a bear market is the boogeyman hiding in the closet. The threat of an agonizing downturn often leads investors to carry lower equity weights in their balanced portfolios than might be advisable, and even drives them to hold excess cash to avoid the risk of sizable declines.

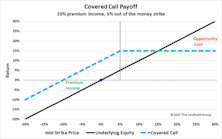

ETF families have responded to this anxiety with a fund design that takes some downside risk off the table and may enable investors to tiptoe into equities even when they suspect a selloff might be around the corner. Known as “buffer”, “defined outcome”, or “target outcome” funds, these ETFs utilize an options collar overlay to trim the upside and downside tails of the underlying asset’s return distribution, thereby giving nervous investors a more comfortable way to pick up some equity exposure during riskier times.

Research Preview: Is Buy-Write The Right Buy?

Many investors appreciate the benefit of covered-call strategies, but we wonder how many truly understand the opportunity costs of buy-write funds over time—or under differing conditions. On the surface, these approaches are simple, but they have complicated payoff patterns relative to stock and bond funds.

The Return Of Returns

A distinguishing feature of fixed income securities is that the expected return on a bond over its remaining lifetime is known with considerable certainty at the time of purchase. This characteristic can be a blessing or a curse, the negative aspect coming into play during an asset price bubble. Equity investors can justify almost any price as they dream of boundless riches arising from the bubble’s driving theme, limited only by their imagination. However, a bond’s yield to maturity is known at the time of purchase and this is the return investors in aggregate will earn. Even during the euphoria of an asset bubble, the expected outcome - the return of par value at maturity - is also the best-case outcome, and that is where our story begins.

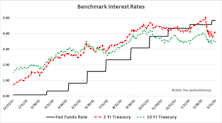

Research Preview: Oh Bond Pain

Here we evaluate the returns of fixed-income ETFs since the Fed began its boosting campaign last March; for many mainstream offerings, the picture is not a pretty one. We recap the pain felt by investors in conventional fixed-rate bond funds.

ETFs Evolving: Make Mine Mint Chip

The ETF concept began as a vehicle to provide low-cost access to a broad market index, and the terms “passive”, “cheap”, “index”, and “ETF” were often used synonymously. However, ETFs soon evolved into specialty funds that allowed investors to take focused active tilts in sectors, styles, and countries; a landmark shift away from the notion of passively investing in the total market. These specialty funds are easy to trade and tax efficient, but they do not fall under the labels of cheap, passive, or broad market.

Research Preview: The Evolving ETF Landscape

Exchange Traded Funds came to life in early 1993 with the launch of SPY, a passive fund tracking the S&P 500. Subsequent ETFs followed in the S&P MidCap 400 (MDY), the Dow Jones Industrial Average (DIA), and the NASDAQ 100 (QQQ). Still, six years after SPY’s debut there were only four domestic equity ETFs outstanding at the end of 1999.

Tactical Junk

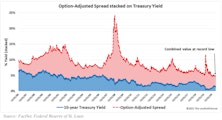

High yield bonds returned a robust 15.4% in the year ending June 30, extending a winning streak that produced a 56.4% cumulative return since the end of 2015. After a quick, severe drawdown at the height of the COVID-19 scare, junk bonds have experienced nearly ideal market conditions, heralding a return to trends that have been in place for several years. The post-pandemic move toward this record low has been a boon to high yield bond investors, but it has also created a significant risk of reversal. We believe most things in the financial markets are defined by cycles, with Treasury yields and credit spreads no exception. Tight readings for both rate series demand that we consider the possibility that a cyclical reversal could weigh on junk bond prices going forward.

Infrastructure Spending & Beneficiaries

While not yet set in stone, it is the consensus view that infrastructure spending will be raised to a higher level for the next few years compared to past baseline expenditures. Although the exact numbers are still unknown, we examined the President Biden-endorsed bipartisan plan to provide a picture of the relative scale of the anticipated spending in the context of historical trends. In addition, we identified a group of industries that may be beneficiaries of the proposal.

Research Preview: High Yield’s Heyday

High yield corporate bonds returned over +15% for the twelve months ended June 30th, building on a strong five-year run that was interrupted by a short, but painful, drop at the onset of COVID-19. Chart 1 indicates that high yield bonds compound at a remarkably steady rate, with infrequent but severe drawdowns during times of financial stress.

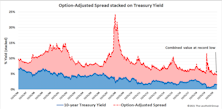

Newfound Popularity Of Thematic ETFs

We’ve noticed a small segment of equity ETFs, designated as “thematic,” that is increasingly gaining popularity. Thematic ETFs invest in baskets of stocks that share narrowly-defined business enterprises outside of the standardized GICS methodology.

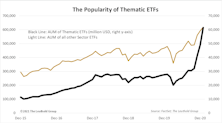

The Relationship Between ETF Fund Flow & Future Returns

In April 2018, armed with a large number of ETFs and long-enough historical data, we applied our back-testing methodology for individual stocks to the universe of ETFs to determine if the same (or some) of those components could useful for assessing ETF performance prospects. One of the factors we reviewed was fund flow (adjusted by AUM), which revealed that those ETFs experiencing the largest asset inflows proceeded to significantly underperform.

The “Pfizer Factor Flip” And Fund Flows

Pfizer’s November 9th announcement of an effective COVID-19 vaccine triggered the most extensive one-day rotation in style factors we have ever seen. Investors flipped from Large Growth—the market’s dominating style over the past few years—and found new friends in Value and Small Cap. This rotation continued through November, to the point that Value and Small Cap each had their best single-month return in 30 years.

Seeking Yield Among ETFs

The 2.00%-4.99% yield range is the sweet spot for yield investors from a risk/reward standpoint; while the other end of the spectrum (>5% yield) incurs too much risk for the fat payouts. Here we spotlight four ETF strategies that focus on dividend paying stocks.

Momentum Buyers: Beware

Momentum is a smart beta factor that gives investors excellent upside participation in rising markets. Most other smart beta factors are defensive plays, so Momentum is the place to be in strong upward moves. Momentum filled that role admirably in recent years, rising 56% from 2016 to the September top, compared to an average of +26% for the other major factors.

Shun ETFs With Largest Inflows

We found that ETFs with the largest one-month, two-month, and three-month fund inflows underperformed going forward. When further broken down by sub-asset class strategies, this pattern is pronounced among equity ETFs, while fixed income ETFs do not appear to be affected by fund flows.

Too Early To Dethrone Dividend Stocks?

In the context of a low growth/low inflation environment, with the Fed taking its time to guide rates upward, fixed income type of investments may pale by comparison to dividend paying stocks.

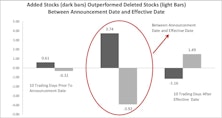

“Index Rebalance Effect” On Stock Performance

Stocks selected for inclusion in the MSCI ACWI have outperformed from the day of the announcement to the day of implementation, while the opposite is true for stocks which are removed. Long-term, however, stocks included in the index do not outperform compared to those that were removed.

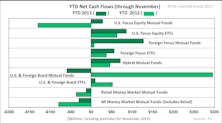

A Shift In Fund Flow Trends Holds Through Latter Half Of 2013

Both equity and bond categories set all-time nominal net cash flow records.

2013’s Fund Flow Trends Have Room To Run

Year-to-date, equity funds are cash on par with those of the 2000 tech bubble, while bond mutual funds are experiencing net cash outflows for the first time in a decade.

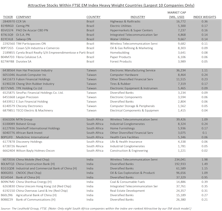

Stock Picking Opportunities From Emerging Market ETFs

Changes in a major EM ETF’s benchmark and another big player’s new EM ETF introduction could provide stock pickers opportunities in select Emerging Markets.

Market Worrying You? Just Sleep On It!

A rather surprising discovery when comparing intraday versus overnight market price action, and perhaps a “Smart Money” buy signal revealed as well?

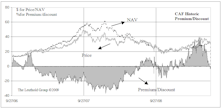

Perspectives On Gold: Relationships That Help Us Understand Gold Price Movements

All our asset allocation portfolios have commitment to gold and silver. This month’s “Of Special Interest” focuses on the yellow metal. Valuation matrixes are of little use, but we do present a variety of relationships that may help at least understand the price movements of gold.

China Equity Market: Investment Vehicles For U.S. Investors

Looking at alternative ways to play China. See this month’s list of H-shares trading in U.S. markets.

Excerpts From Our New ETF Study

An In Focus Special Research Study sent in late April provides a detailed look at the growth of the ETF industry and endeavors to organize the ETF universe into meaningful categories.

Mutual Fund Flow…..Moderate Net Inflow Estimated For November

While November’s net inflow of $3 billion into traditional open-end equity funds is a break from this recent outflow trend, it’s still a stretch to say that Main Street investors are embracing stocks once again.

Mutual Fund Flow…..Light Net Inflow Estimated For October

U.S. focus equity fund net inflow of $1.5 billion is estimated for October, which ends two consecutive months of net redemptions in August and September.

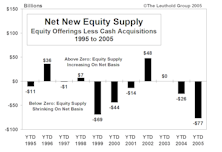

Stock Market Supply/Demand: The Four Most Interesting Trends Of 2005

In reviewing the numerous Supply/Demand factors we track, there were four trends that are perhaps the most important and/or most interesting on this front so far in 2005.

Mutual Fund Flow…..July Flows Remained Light

Despite evidence to the contrary, many continue to think that investment in exchange traded funds is commanding the lion’s share of new money flow going into all equity funds.

January Mutual Fund Flows...Light Flows Are Troubling

It is clear Main Street investors have become more apprehensive about the stock market compared to 12 months ago when confidence was higher.

Offshoring The Next Bubble?

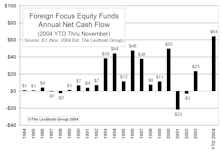

Main Street’s rush into international stock funds could be foreshadowing tougher times ahead for foreign markets.

July Mutual Fund Flows...Main Street Is Cooling Toward Stock Market

Clearly, in recent months, the public has become much less enthusiastic about the stock market.

Are Most ETFs Un-Investable For Institutions?

Much has been made of ETFs, and their ability to attract fund flow. However, outside of SPDRs and QQQs, the liquidity and asset base of most ETFs is minimal and makes investing in most ETFs near impossible for institutional investors.

The Impact Of Exchange Traded Funds (ETFs)

The popularity of SPDRs has opened the floodgates for new species: VIPERs, HLDRs, and iSHAREs.

.jpg?fit=fillmax&w=222&bg=FFFFFF)