Foreign Markets

Research Preview: Returns In A Year Of Dollar Strength

The U.S. Dollar Index (DXY) has gained 16.2% YTD, its best performance in almost 40 years. However, a strong dollar is bad for those with international investments, as returns are slashed when translated back into dollars.

The King Is Dead: A Global Chartbook

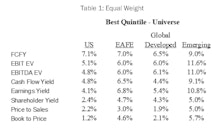

Last year we published a report titled Price to Book: The King is Dead (available on the Leuthold Research website) with the objective to better understand the decade-long struggle of the value style. Our findings showed that indexes based on the Price to Book ratio have indeed lagged since 2007 but that other measures of value performed significantly better until just recently.

Still Tracing Out A Top

Major market tops are drawn-out processes that can prove costly, and infuriating, to bulls and bears alike. Younger readers might be surprised to know that was true before Twitter.

The Downside Of A Domestic Focus

We weren’t prepared to find industry price trend persistence so much more predominant at the global level than it was domestically.

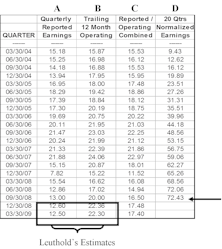

Normalized Earnings…..A Primer

Normalized P/E ratios show stock market to be cheap, but what are “normalized earnings”? We present our methodology and rationale is this month’s “Inside The Stock Market” section. While U.S. stocks are cheap, foreign stock markets look even cheaper.

U.S. Market Remains Relatively Overvalued Compared To Rest Of World

U.S. stock market is relatively overvalued on a composite basis when considering P/E, P/B, P/CF, Yield, and Market Cap/GDP.

Japan Investors Are Not Forever

A number of factors have, in recent months, combined to create strong Japanese demand for U.S. equities, especially the known recognizable U.S. names. But keep in mind, attitudes and current conditions can change almost overnight.