GDP Growth

Is Good News Ultimately “Bad News?”

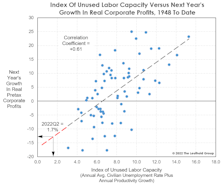

Let’s momentarily imagine that both the Index of Leading Economic Indicators and the yield curve “fail,” and a recession in 2023 is sidestepped. What might the GDP growth outlook be in that scenario? It wouldn’t be good, and (ironically) that’s because of strong labor market conditions on which the economic bulls now rest their case!

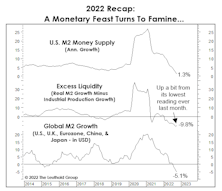

Illiquidity Rules The Day

Nearly everyone would cite high inflation as the dominant theme of 2022. But we think that the evaporation of a one-time ocean of liquidity better explains the horrendous backdrop for stocks and bonds. High inflation sped up the rate of evaporation, but it was going to occur anyway.

Interrupting The Recession Debate With A Reminder Of How Hot The Economy Is

“Money illusion” continues to complicate analysis of the economy and financial markets. It might be a time when age and experience will actually prove helpful: Only investors who are 65 or older have experienced gaps between “nominal” and “real” data as wide as today’s.

Labor Is The Limiting Factor

If the economy slips into recession, the Fed will get all the blame. But it’s worth taking a step back to consider that the die has already been cast: The “capacity” for the U.S. economy to grow is nearly exhausted. Specifically, we’re referring to the capacity available in the labor market.

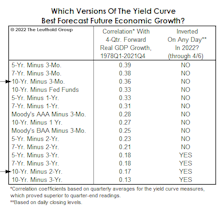

The Terrible “Two-Year”

In a simple test of 15 yield-curve variants, we found that the 2s10s spread ranks second to last, based on its correlation with one-year-forward real-GDP growth since 1978. The three best measures employed the 3-month bill as the “short” rate. The spread between the 5-year note and 3-month bill showed the strongest correlation with subsequent economic growth.

“Plotting” The Course For 2022

The economic expansion officially entered its 22nd month in February. In dog years, that translates to an age of 13—the same age the recovery might have reached this July if not for the COVID disruption. The late-cycle characteristics displayed by a recovery that’s statistically so young dissuade us from issuing a high-conviction forecast for 2022.

Emerging Markets EPS: There's Many A Slip...

If there is one thing sure to make equity investors swoon, it is the prospect of buying into a credible, long-lived secular growth story at a relatively modest valuation. Over the past three decades, Emerging Markets (EM) have proffered just such an opportunity. EM’s economic growth rates have far surpassed those of developed nations, and the valuations attached to EM stocks have often been at a discount to other markets.

However, this combination of secular growth and attractive valuations has not always paid off for investors. The MSCI Index has underperformed the U.S., Europe, and even Japan over the last ten years in local currencies. Furthermore, EPS growth for the EM Index has come in far below its economic growth rate, creating an exasperating drag on Index performance as it tries to keep up with other regions.

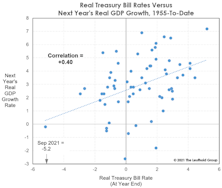

Rethinking Real Rates

Consumer Price Inflation has stabilized in the 5.2–5.4% range in the last two months, giving the Fed hope that it’s reached a near-term peak. Still, the presence of 5%-plus inflation in the face of ZIRP leaves the real short-term Treasury-bill rate about as deeply negative as it has ever been.

Research Preview: Emerging Markets’ Leaky Bucket

Investors view Emerging Markets (EM) as the best source of economic growth across global equity markets, and rightly so. Annualized EM GDP growth of 8.6% since 2001 is more than double that of the U.S. and Europe. However, investors have not captured this extraordinary advance because earnings per share for the MSCI EM Index have lagged far behind EM economic growth rates.

A Lost Decade For Emerging Markets

Fading momentum in GDP growth, sizable dislocation of corporate EPS in the midst of an expansion, and U.S.-dollar weakness have all made EM equity investments inferior to U.S. stocks over the last decade.

The Case For “Five Percent”

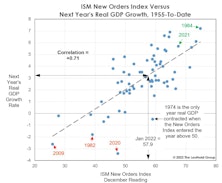

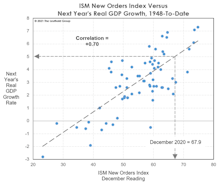

Forecasting GDP is hardly our forte, but 2021 should see a very big gain in real output. Our current guess is for real GDP to grow 5% this year. Statistically, though, that doesn’t imply that the stock market’s move will also be large (or even of the same “sign”).

Stocks And GDP

Economists argue the best thing the stock market has going for it is the continuation of the U.S. economic expansion. Maybe.

Is A Strengthening Dollar A Form Of Policy Tightening?

Executive summary (for those leaving early for the holiday weekend): No.

We’ve found no reliable relationship between swings in the U.S. Dollar and subsequent variations in U.S. economic growth.

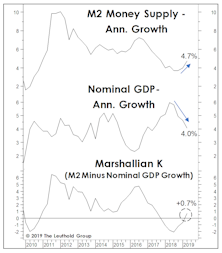

Who Doesn’t Love “Excess” Money?

We’d concede the monetary backdrop for stocks is now mixed, an upgrade from the almost uniformly negative environment of last fall. On the negative side, the U.S. yield curve inversion has now persisted long enough that even the economic optimists are getting nervous.

Inveighing Against The Inversion

Some recent headlines are word-for-word regurgitations of those published in response to the early-2006 yield curve inversion. In that case, the naysayers were temporarily correct, as both the U.S. economy and stock market pushed higher for another year and a half before rolling over.

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)