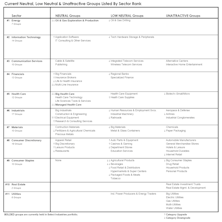

Group Selection Scores

Multi-Year Holdings Key To Select Industries

The GS Scores help Leuthold Select Industries portfolio identify underappreciated themes that can turn into multi-year holdings. Managed Health Care has been a holding for over 13 years, while Semiconductor Equipment (seven years), and Homebuilding (six years) have also been long-term winning positions.

Rate-Sensitive Groups Dominate Unattractive List

Utilities, Real Estate, and Consumer Staples are the bottom three sectors among the GS Scores.

Rankings At The Top Offer Diversified Mix

Energy remains the top-rated sector, but Information Technology, Communication Services, and Financials follow closely behind. These offer a diverse mix of commodity, growth, and cyclical options.

Leuthold Select Industries Portfolio

Select Industries has overweight positions in Energy, Materials, Consumer Discretionary, and Industrials. The portfolio has no exposure to Consumer Staples, Real Estate, or Utilities.

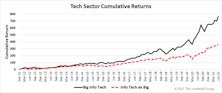

Big Time

Market environments are driven not just by industry preferences, but also by a bias toward the very largest companies. We have developed a new set of groups composed of the 10 largest companies from each sector. With several of these baskets sporting positive rankings, we felt a closer look was in order.

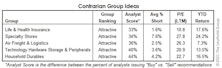

Our Most Contrarian Industry Group Ideas

Contrarian investing is difficult from both an emotional and implementation standpoint. Often the consensus is right, and industry groups are out-of-favor for a reason. As the saying goes, “Don’t be contrarian just for the sake of being a contrarian.”