Homebuilders

The Economy Rallied In January, Too

The narrative for January’s strong stock market bounce is that not all key economic releases looked to be forecasting a recession. However, one must consider that this was only true for coincident and lagging data series.

The Housing Market Is A Trip!

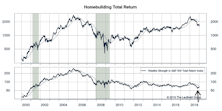

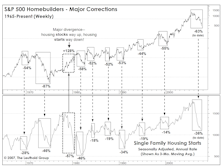

In mid-May, S&P 500 Homebuilders officially became a COVID “round-tripper”: After a one-month COVID collapse of 53% and an ensuing rally of almost 250%, this year’s selloff drove Homebuilders to a May 11th close that was a few ticks below its pre-COVID high. Imagine what might happen if the housing market cracks?

Housing: Saner Than You Think

On a technical basis, Homebuilding stocks have only just emerged from their decade-long post-bubble bust. With P/B 24% below the mid-2005 peak and 15% below the “overvalued” threshold, they look reasonably priced in a world that’s almost entirely devoid of value.

Homebuilders: The Weird And Unexpected

Like many years, 2020 is one in which an investor who was armed with a perfect economic forecast would have been befuddled by stock market action. Who would have imagined that passive equity investors (including many posing as Wall Street strategists) would be so well-rewarded for ignoring the economic downturn?

Housing Affordability & Homebuilding Stocks

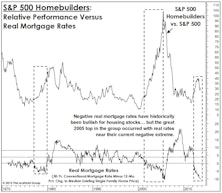

The Homebuilding stocks represent another Consumer Discretionary group ranking Attractive via our GS Scores; we have held the Homebuilding group for the last year and a half. Homebuilders is an extremely rate-conscious industry group given mortgage rates’ impact on housing affordability (and thus, demand).

Homebuilding Stocks—Still Time To Buy?

Homebuilding Stocks Are On A Stellar Run—Can The Streak Continue?

Homebuilding, More Than Just Curb Appeal?

While this Consumer Discretionary group has not experienced six-plus-years of market outperformance, we think it may be poised for a late-game bounce. An overall lack of housing options may be just what this industry needs to give it a long-awaited boost.

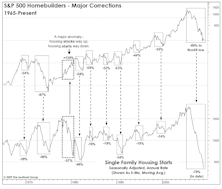

Housing: Curb Your Enthusiasm

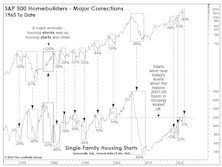

Despite record low mortgage rates and pressure to re-loosen down payment and lending requirements, single family housing starts have yet to recover to levels consistent with even the average recession trough.

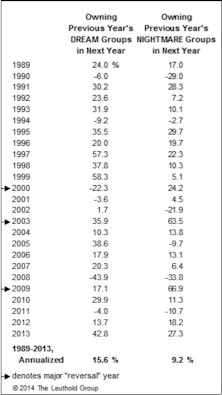

The Dreams & Nightmares Of 2013

For 25 years we’ve tracked hypothetical industry group portfolios comprised of the previous year’s “Dreams” (20 best performers) and “Nightmares” (20 worst performers).

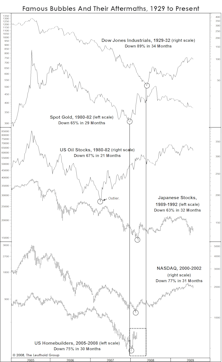

Housing: Just Like The Bubbles Before It

Sectors that become the object of obsession during one economic cycle tend to remain cyclically depressed in the following one.

Handicapping The High In Housing

Today it seems taken for granted that the great housing meltdown of 2006-2010 was sufficient to purge the last decade’s excesses, and that housing can now be relied upon as one of the drivers of a slow but elongated U.S. economic expansion.

Rates Too High For A Housing Rebound?

Are mortgage rates still too high for a rebound when looking at real mortgage rates?

What Keeps Us Up At Night

We consider it incredible that most of the leading economic indicators have staged such traditional V-shaped rebounds with virtually no boost from the housing sector.

A Ray Of Hope For Housing

If the November lows in the Homebuilders holds, based on the leading relationship between stocks and starts, an upturn in housing starts (not the broader economy) should be imminent.

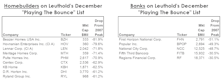

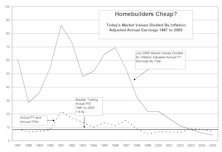

A Discount Shopping Guide To Banks And Homebuilders

With a heavily promotional holiday shopping season underway, we feel compelled to join the fray by looking at the big markdowns in U.S. homebuilding and bank stocks.

Homebuilders.....Watching The “Window”

Not all gloom and doom this month...Homebuilders approaching window where past busted bubbles have bounced.

Housing: Still Too Early To Invest (Or To Build)

It’s still too early, but at some point in the next 6 to 18 months, going long the homebuilders will probably become the single most contrarian—and potentially highly profitable—thing to do. But before that happens, we expect to see more blood in the streets.

The Homebuilding Group – Value Play Or Value Trap?

Everybody sure hates the Homebuilders. However, contrarians should take note of this month’s analysis of earnings prospects, insider selling/buying, and the outlook for future housing starts. Now is not the time to be bottom fishing here.

Answering Client Questions

Many of the questions in this month’s issue came from November’s client meetings in San Francisco.