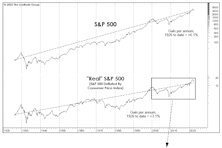

Inflation-adjusted “Real”

Remember When?

Remember the good old days (like even a year ago) when one didn’t need to mentally tabulate investment results in inflation-adjusted terms? For a blissful couple of decades, nominal and real returns were so close together that the latter figure seemed irrelevant.

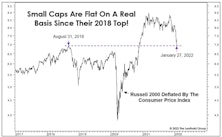

Small Caps’ Three-Year Ride To Nowhere

Yesterday, the Russell 2000 closed down 20.9% from its November 8th high, and market bulls have conceded it was “due” for a pullback after a 146% gain off the March-2020 COVID lows.

The Russell’s decline is moderate by the historical high-beta standards of Small Caps. However, this drop—combined with other developments transpiring over the last few years—has produced a shocking result: The Russell 2000 is now unchanged on an inflation-adjusted basis since its “Quantitative-Tightening Top” of August 31, 2018. But what a three-year ride it’s been!

Only The Shadow Knows

If the above observation from almost a century ago remains on the mark (as it has for almost a century), then both the cyclical bull market and accompanying economic expansion should remain in force during the next several months.

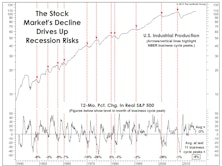

Recession? Too Early To Call

Among the various arguments put forward by those believing the recent decline is no more than a correction, the most difficult for us to address is the common claim that “there’s no recession on the horizon.”

Little To Complain About

From a pure price action perspective, it’s difficult to find cracks in the bull market’s edifice.