Info Tech

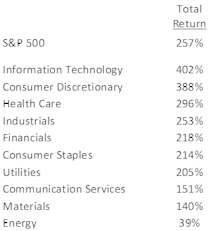

Industry Returns: The Decade’s Winners & Losers

This “decade in review” edition examines the performance of sectors and industries, looking at the best and worst groups to reveal the stories they have to tell.

Sector Rankings

For the sixth consecutive month, the top-three rated sectors are Health Care, Consumer Discretionary, and Info Tech. Rounding out the bottom end of the rankings are Materials, Energy, and Consumer Staples.

A “Measured” Melt-Up

The stock market “melt up” scenario is underway but has proven less broad than we expected. Just as in the late-1990s, Technology and NASDAQ are the main subjects of investor adulation.

Old School Tech Flies High; Semi Equipment Revisited

Although the glamorous Tech giants have captured investors’ attention of late, from our perspective, the old school, physical Semiconductor plays hold the greatest appeal.

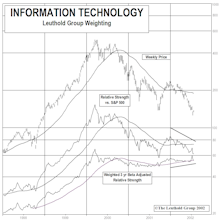

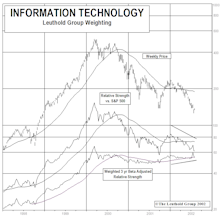

Technology: Popping The “Bubble” Talk

The S&P 500 eclipsed the “Twin Peaks” (2000 and 2007 highs) in 2013, and two years later the NASDAQ topped its 2000 high.

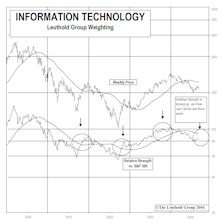

Thoughts On Long-Term Leadership

Bubble groups rarely return as market leaders until after experiencing a prolonged trading range pattern. Technology currently appears to have paid its dues and could develop into the next market leader.

Technology: Seven Years After The Bubble And Still Struggling

- Our quantitative work on technology remains poor, and only a single tech subgroup—Technology Distributors—makes our current Attractive list. Per the Group Selection disciplines, there are currently no technology stocks in our Select Industries portfolio.

- Tech’s underperformance has helped restore better relative value to the sector, but valuations aren’t yet cheap enough for a big “reversion-to-the mean” bet.

Sector Spotlight...on Technology

Looking for Q4 tactical trading opportunities in Tech.

Is The NASDAQ Recovery Over?

NASDAQ was only index to decline in February. Some are wondering if the rally is over for the NASDAQ. This month’s “Of Special Interest” looks at past NASDAQ recoveries.

Tech Watch

GS Scores for Tech groups have been fading in recent months, with only one Tech group now viewed as Attractive. The quantitative deterioration prompted us to reduce portfolio Tech exposure.

Tech Watch

The broad Tech sector has rallied significantly from lows and is not cheap by traditional valuation measures. Upside driver must be earnings momentum, which continues to be strong.

Tech Watch

Technology stocks rebound off late September sell off. The NASDAQ records its thirdbest month this year (+8.1%), and is now up 44.7% YTD.

Tech Watch

Technology stocks retreat in late September. The NASDAQ records its first down month this year (–1.3%), but finished Q3 up 10.1%.

Tech Watch

Still overweight Info Tech, but stock selection likely to get tougher in coming months.

Tech Watch

This may be one of the few sectors that has the opportunity to provide 20% or more growth in 2003. If investors can get over their fears, they could be rewarded by the Tech sector.

Tech Watch

Technology stocks UP BIG AGAIN in May. The NASDAQ gained 9.0% for the month (9.2% last month), second again only to the Russell 2000.

Tech Watch

Technology stocks up BIG in April. The NASDAQ gained 9.2% for the month, secondonly to the Russell 2000 in terms of performance.

Tech Watch

The broad Tech sector is down significantly from all time highs, but is still not cheap by traditional measures.

Tech Watch

For the second month in a row, the NASDAQ was the best performing major index.

Tech Watch

The broad Tech sector is down significantly from all time highs, but is still not cheap by traditional measures. Upside driver will have to be new earnings momentum developing.

Tech Watch

Technology stocks retreat in December, as our broad tech index lost 16.0%. However for all of Q4 Tech was up 33%.

Tech Watch

Technology stocks soar again as our broad tech index gained 26.4% in November.

Tech Watch

October provided welcomed relief for technology stock investors. After an average loss of 18% for tech stocks in September, the October rebound came along and more than made up for the loss in most cases.

Tech Watch

Still extremely risky area of equities, but recovery may be near. Currently rank six tech groups “Attractive”.

Tech Watch—Pockets of Strength Beginning to Emerge

Stock selection and small cap focus have provided the only hopes of surviving this decimated sector.

Tech Watch

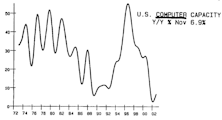

Fundamentals continue to build for technology, but prices yet to react…..Evidence that tech fundamentals are now improving.

Tech Watch

Fundamentals continue to build for technology, but prices still not cheap. Semiconductors continue to show stabilization. Japanese shipments above median for first time in over a year.

Tech Watch

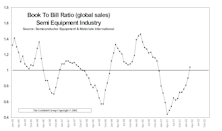

Book to Bill ratio continues to improve. Some solid evidence that the prospects for the chipmakers are looking up.

Tech Watch

Time to buy Semiconductors? Some early evidence that the prospects for the chipmakers are looking up.

Tech Watch

Tech still down big from all time highs, but still not cheap. Upside driver will have to be new earnings momentum developing.

Tech Watch

S&P Tech clobbered in February, but median PE ratio still rising for 6th straight month as almost half of our tech index has no earnings.

Tech Watch

S&P Tech up slightly in January, but median PE ratio rises for 5th straight month as poor earnings are reported.

Tech Watch

S&P Tech remained flat in December, but P/E ratios continue to climb as poor earnings are reported.

Tech Watch…..S&P Tech Subset Soared Again. Up 16% In November

Tech soared again in November despite cratering earnings.

Tech Watch…..S&P Tech Subset Soared 16% In October

From a much lower base, at least some tech stocks could once again become earnings momentum plays.

Tech Watch…..Strong Bounce In April

Tech stocks came roaring back in April (Info Tech sector up 22%), but don’t expect another parabolic rise!

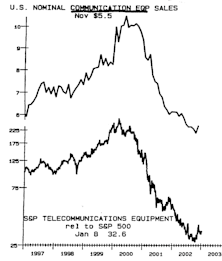

Repeat: Big Money Will Be Made Here...Some Day

Here is a sector we have recently added to our stable for tracking purposes.