Integrated Oil & Gas

Energy Makes Its Move

After years of languishing in the rock bottom of Group Selection Scores and sector rankings, Energy exploded higher this month, jumping from 10th lowest (out of eleven broad sectors) to 3rd highest in our composite rankings.

Water Utilities Take A Dive

Integrated Oil & Gas and Oil & Gas Drilling are this week's best groups. Real State Investment Trusts and Water Utilities are this week's worst groups.

Humble Oil

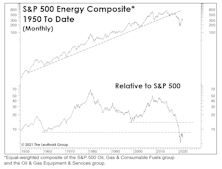

With Energy stocks underperforming the S&P 500 by 20% YTD, contrarian clients are wondering if the sector holds any promise. Here we look for valuation signals that offer encouragement for bargain-hunting investors willing to buy on weakness.

Energy Rates At 4-Yr High; Bought Integrated Oil

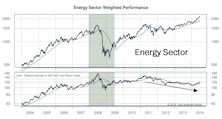

Strength in the Energy sector has been so compelling that our two recent Energy group allocations together now make up a 10% portfolio weight, after having no Energy exposure from June 2013—April.

Defensive And Commodity Groups Improve

Two Consumer Staples groups upgraded to Attractive this month, Beverages and Tobacco. The Energy sector saw Integrated Oil & Gas upgraded to Attractive.

New Group Position: Integrated Oil & Gas

The Integrated Oil & Gas group was bought in the Select Industries Portfolio in late February. The group has been rated Attractive a majority of the time since November 2010.

Crude Oil Regression Analysis

Analyst estimates for oil stock earnings never seem to fully capture the impact that the price of oil has on their earnings.

Cautious On Oil Stocks In The Short Term

Surprised that crude oil did not soar above $70. Price of crude seems to have double topped at $70 and some correction is expected in coming months.

Further Upside In Integrated Oil?: Analysts’ EPS Estimates Still Appear Too Conservative

Revised forecasts again appear to be too conservative given prevailing spot and futures prices.

Sector Spotlight...Energy

Based on oil futures prices, 2005 year-end consensus earnings forecasts for the Integrated Oil & Gas group appear too low! These too-low forecasts imply further upside for oil shares, and, at the very least, limited downside relative to the rest of the market.

Up with The OiIs

We have increased our Oil Patch holdings by 5%, now 14% of Equity Portfolio assets. The recent spot oil price trends now seem to confirm our preliminary conclusion that crude price declines are over…..at least for a while.