IPOs

Speculating In “The Nebs”

One measure of a bubbly bull market is the degree of speculative fervor embedded in the prices of companies with nebulous, indeterminate, or even nonexistent intrinsic values. Since the bear market low in March 2020, speculative manias have evolved in a menagerie of asset classes including Innovators & Disruptors, SPACs, meme stocks, crypto currencies, and NFTs. Based on the breadth of valuation extremes across numerous and diverse assets, this bull market may rank second to none.

“Memes” Need Money Growth...

The extra months of QE “auto-pilot” failed to support some of the themes we’d have thought were the most likely to benefit from it—including IPOs, SPACs, Bitcoin, and the sky-high growers favored by the ARK Innovation ETF. Instead, the smart play with each of these assets was to ignore the ever-expanding Fed balance sheet and sell in February.

SPACs: Fashion Or Fad?

Special Purpose Acquisition Companies (SPACs) have become increasingly popular of late. We ask a seemingly simple question: “How do companies fare following a SPAC merger?”

Deal Flow On The Comeback Trail

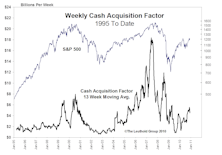

Offerings are beginning to pick up. While not even near the levels of excess, the trend bears watching. The initial surge in offerings is typically indicative of a rising market.

A Better Take On Equity Offerings…..Some Bullish Surprises From The Supply Side

Lately, there has been renewed interest on the topic of new equity offerings, and not without good reason. After a three-year dry spell in underwriting activity, the offerings calendar has seemingly sprung to life in 2004.

August Mutual Fund Flows...Right In The Comfort Zone

Past bear market recoveries typically saw Main Street investors sit on the sidelines as market conditions improved…..but not this time.

Focus On Equity Supply

This year’s equity offerings volume, as measured by common shares in IPO and secondary financings, finished the year well below the levels of 2000.

Internet Insanity Index

The insanity continued in January, with the Internet stocks up 56.9% during the month.

The 1996 Transition

April market showered investors with several interesting changes. Technology stocks recovered their sizzle as PC shipments came in better than expected and Internet buyout fever ran prices up. Secondary stocks scored a TKO.

Major Trend Index Remains Neutral

The U.S. stock market environment seems to be pretty much a continuation of the 1993 frolics, big new supply and continued institutional buying as professionals invest new cash flow from individual investors who don't know that Wall Street can be a two way street.