Life & Health Insurance

Highlighted Attractive Groups

Airlines, Life & Health Insurance, and Household Durables are among the month’s intriguing opportunities based on the current Group Selection (GS) Scores.

Financials With Post-Election Appeal

Forces specifically driving many Financials groups include expectations for an ongoing yield rally and a steepening yield curve, tax cuts, and loosening financial regulation. While these outcomes remain largely speculation, the odds have improved and any of these developments would be a welcome change.

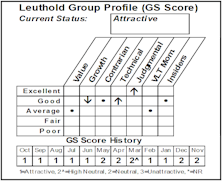

Insurance Theme Intact Among Top GS Scores

Group Selection (GS) Score strength among insurance-related industry groups has been a long-running theme within our quantitative framework.

Broad Themes Found In Auto & Insurance Industries

We like when we can find groups inside of broad themes, and these two industries are amongst the strongest in our work right now.

Select Attractive Domestic Groups

Auto Parts & Equipment, Systems Software, Life & Health Insurance and Life Sciences Tools & Services are featured this month.

Select Domestic Groups Upgraded To Attractive

Property & Casualty Insurance, Life & Health Insurance, Restaurants, and Apparel, Accessories & Textiles all moved into the top quintile.

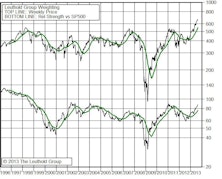

New Select Industries Group Position– Life & Health Insurance

Life & Health Insurance has rated Attractive for five months now, steadily climbing up the rankings during that time.

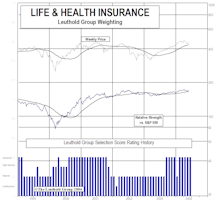

Nibbling At The Financials - First Group Exposure Since 2001

Making first Financial sector purchase since 2001, buying Life & Health Insurance. On a selected basis, there are pockets of attractive Financial groups, but we still advise being underweight this sector.

New Select Industries Group Holding: Life Insurance

Buying Life & Health Insurance giving the Paid To Play Portfolio 12% more exposure to the broad Financial group as Fed tightening may be in its final stages.

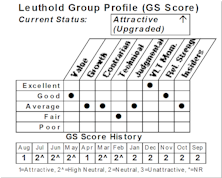

Insurance…Life: Increasing Portfolio Holdings

Boosting commitments in this sector by 5%. We expect lower interest rates over the next 6-12 months, and this sector should benefit.

Life Insurance: Being Activated in Both Portfolios

Establishing a new portfolio holding in “Life Insurance”, a sector ranked as Most Attractive for seven of the last eight months.

In Search of the Meaning of Life (Insurance)

We are activating the “Life Insurance” concept in September and plan to have an initial exposure of about 6% of our Model Equity portfolio. The sector has picked up on a relative basis in 1992, aided by declining interest rates, improved cost structures, and some reduction of concerns over real estate exposure.

Why We Are Adding Life Insurance Stocks to the Equity Model

This may be just the type of stock that is appropriate for the late stages of a business expansion. We would expect these investments to hold up pretty well in a down market. In other words, this sector looks to be “defensive”.