Low P/E

Low P/E Track Record

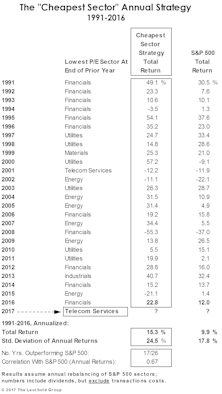

Financials was the “cheapest sector” in each of the last three years, and its significant underperformance versus the S&P 500 has shaved the historical “alpha” from this strategy. Still, those souls who’ve had the stomach to own the Low P/E sector each year have beaten the S&P 500 by 2.9% per annum since 1991.

For Value Investors Only!

With the Bridesmaid approach we’re attempting to capture “stealthy momentum,” rather than pure momentum. Fundamentalists—and especially value investors—might find that to be a distinction without a difference.

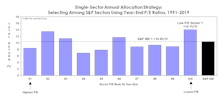

Low P/E Track Record

The “robustness” of the “Cheapest Sector Strategy” concept is illustrated by strong results across all rebalancing frequencies.

For Value Investors Only!

With the possible diminution of “alpha” in price momentum strategies, we recommend that sector allocators consider approaches that are more countertrend or contrarian in nature.

Bridesmaid Strategy - Valuations

Momentum strategies aren’t for everyone. Still, contrarians should recognize that buying the prior year’s worst performing sector for a one-year hold has been an underperforming proposition over the long term.

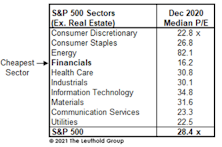

Low P/E Sector: Annual Results

Table 6 summarizes annual sector selection and accompanying performance for the “Cheapest Sector” strategy back to 1991.

Hate Momentum? Try This...

Not wanting to be seen as shameless shills for momentum investing, we’ve developed a contrarian alternative to the Bridesmaid sector approach that’s delivered even better long-term outperformance. It’s based on the holy grail of value investing: Low P/E.