Major Advances

Feeble Bull Or Hibernating Bear?

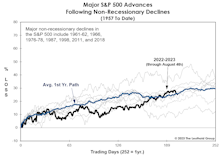

At last October’s lows, we had yet to see any manner of economic, monetary, and valuation “reset” that would clear the path for a resilient cyclical bull. And, in the 51 weeks since that bottom, U.S. economic, monetary, and valuation conditions have only deteriorated further.

Don’t “Bank” On A New Bull…

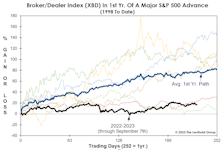

The Broker-Dealer Index (XBD) is one of just a handful of indexes to surpass its old bull market high, but its gains are far below average for the first year of a major advance. Meanwhile, the BKW Bank Index (BKX) is revisiting price levels of 25 years ago—it is just one percent above the average daily close in 1998. Yes, as a group, the big banks have been dead money for 25 years (excluding dividends).

Lowering The Bar!

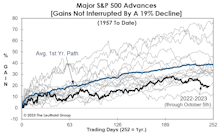

As we’ve noted, none of the major indexes has kept pace with the typical path traced out during past cyclical upswings. It has since occurred to us that this nearly ten-month stock rally is being compared to an unrealistically high standard: The current advance doesn’t have the advantages enjoyed by bulls that launched out of recessionary conditions.

Premature Aging?

If today’s stock market is indeed a new bull, its vital signs advise that it is more in need of a coffin than a cradle. Monetary policies, both in terms of rate hikes and the inverted curve, have never been more hostile at this stage of a major stock market upswing.