Margin Debt

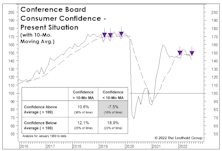

Confidence Cracking?

The theory of “contrary opinion” is important to market analysis, but so is an understanding of its limitations. When investor-sentiment surveys dipped sharply in late January, we warned that the declines (which are usually signals to “buy”) might instead mark the beginning of an important trend change.

Sentiment: Why The Long Faces?

Those who want validation to buy aggressively with the market down 10% can reference two historically reliable, intermediate-term sentiment measures with fresh BUY signals—and there’s a third one that’s also very close to triggering a BUY. The problem is that boundaries defining extreme psychology change over time—with a key inflection occurring as the market transitions from bull to bear.

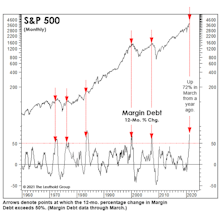

How Much Leverage Is Too Much?

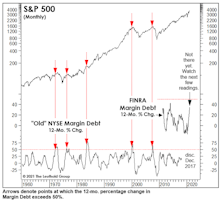

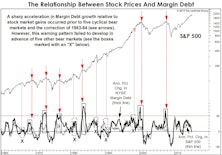

FINRA’s latest report shows a 72% annual gain in margin debt. Yet, in relation to the gain in stock prices, growth in Margin Debt is still well below the peaks of early 2000 and mid-2007—suggesting investors could take on considerably more leverage in the months ahead.

Putting More And More On Margin

In one year, the bull market has persuaded investors to do something they were reluctant to do near the end of an almost eleven-year bull: Lever Up. Year-over-year growth in Margin Debt reached 49% in February and should catapult far above the “conventional” 50% danger threshold with March’s results.

Lever Up!

Someday, we’ll have a chuckle with our (yet unborn) basketball-playing grandson about the time Shaquille O’Neal was able to raise several-hundred-million dollars in his second SPAC. But while these anecdotes get sillier and sillier, we have a personal bias toward speculative activity we can measure over time. That activity isn’t quite as alarming as the anecdotes, but it’s getting there.

A Sign It Could Get “Even Sillier”

The January moves in heavily shorted Micro Caps were more bizarre than anything we saw during the wildest days of the Tech bubble. Despite these signs of rampant stock speculation by the retail crowd, we still wouldn’t characterize today’s sentiment backdrop as frenzied as the peak levels of 1999-2000.

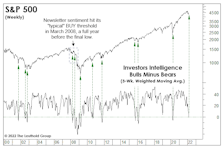

A Whimpering Sell Signal...

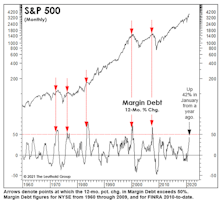

It’s been more than two years since NYSE Margin Debt broke out above its 2007 high, and we remember the rash of bearish commentary that accompanied that milestone. We later showed the Margin Debt increase was almost perfectly proportional to the gain in the stock market itself, and not a reason to turn bearish in and of itself. But our tune has changed.

Margin Debt Revisited

Stock market Margin Debt enjoyed a brief phase of notoriety when it eclipsed its 2007 high just over a year ago, then it retreated into obscurity. Now it may finally be telling us something.

Margin Debt: Much Ado About Not Very Much

Margin debt levels are high, but that’s because stock prices are high. The critical relationship is the comparative rates-of-change in Margin Debt and stock prices.

View From The North Country

Thoughts and commentary regarding the groups in our Select Industries Portfolio, the Mutual Fund Timing scandal, NASD Margin Debt and deficit worries.

Client Questions

Answering client questions on the economic recovery, bull market upside, valuations, Main Street and what could go wrong?

Margin Supports Stock Speculators…As A Rope Supports A Hanged Man

Margin debt creates problem for the market.

View From The North Country

With margin debt soaring, it’s past time for the Fed to boost margin requirements. Charlie Maxwell offers unique insights on the oil patch. Rapidly deteriorating U.S./China relationship could have severe implications.

Margin Debt Huge and Understated?

Margin debt was $116 billion in July, up from $80 billion a year ago. This marks a record high in terms of dollars, as a percent of GDP, and as a percentage of total stock market value.