Market Cycles

Aging Prematurely

Regardless of one’s view on the maturity of today’s economic and market cycles, it’s hard to deny that the continuation of extraordinarily-loose economic policies is now causing those cycles to age prematurely. And no doubt it’s contributing to the premature “graying” of many market participants.

Research Preview: Is “Manager Skill” Cyclical?

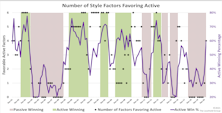

The active-passive performance derby is cyclical, determined not by the ebb and flow of portfolio managers’ brilliance but, rather, by market conditions and the slippage that arises from imperfectly comparing funds and benchmarks.

Factors: Ain’t Misbehavin’

Investment styles and factors are generally interpreted as having an inherent preference for either bullish or bearish market environments. The theoretical tilt of each style is based on its design and its sensitivity to economic, profit, and valuation cycles. However, theory and practice do not always agree, and we must look to actual performance to confirm our impressions.

Research Preview: Factor Standings For 2020

As we review factor and style returns for 2020, it occurs to us that the “whole” is much less interesting than the sum of its parts. Many factors are considered to be either bullish or bearish in temperament, and last year’s round-trip offers an opportunity to test the reliability of those characterizations.

Can Equity Investors Eat Their Cake And Have It Too?

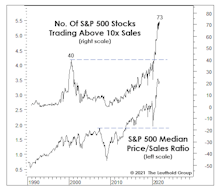

Investor sentiment seems to be unusually conflicted these days. There are worries aplenty, including numerous political skirmishes of consequence around the world, a slowing global economy, and lofty U.S. equity valuations. On the other hand, fiscal stimulus is high for this stage in an economic cycle and the Fed is easing monetary policy, two policy drivers it rarely pays to bet against.

Value, Momentum, And The Stock Market Cycle

Conventional measures of market action, like breadth and industry leadership, point to the formation of a bull market top. Divergences abound.

Ruminations On The Major Trend Index

There are many reasons to think the MTI’s cautionary message should be taken seriously.

Assessing The Cycle….Putting Today’s Growth Into A Historical Context

Within the current cycle, the stock market recovery is mature, but based on the average post WWII recovery could still have some upside (S&P 500 to 1400?). Currently, earnings growth is well beyond historical averages, but the economic expansion is below the norm.

Following The Script?

Yes September is most frequent month to produce declines, but average loss has been only a paltry 1.3%. Also, Septembers following bear market lows (like this year) actually produced strong performance.

Building A Head Of Steam

Based on cyclical bull market recovery from 1973-1974 secular bear market. There is still significant stock market upside from May’s month end price levels.