Market Decline

If Inflation Has Peaked, Thank The Stock Market—Not The Fed

High inflation continues to dominate the headlines, but it is only one piece of the “weight of the evidence” that’s stacked against the stock market. Still, in ironic fashion, stock-market action itself suggests that inflation is set to peak.

“PSsss”

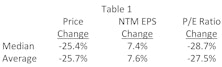

The most brutal bear markets occur when falling earnings are accompanied by shrinking valuations, producing a compound negative effect on stock prices. Investors in 2022 have (so far) avoided this double-whammy in that valuations have taken a hit, but EPS estimates are holding strong. We are intrigued by the notion that 2022’s bear market has, to date, been all about valuation compression rather than earnings weakness. Investors are coping with the problems of the day by letting the air out of bubbly valuations, and this report takes a closer look at the valuation squeeze underlying the current selloff.

Research Preview: P/E Multiple Compression In 2022

Stock market corrections are the result of falling valuations and/or falling earnings, and when both conditions appear together, investors are in for a rough ride. Thus far, the 2022 selloff has been confined to compressing P/E ratios, and we launched a research project to take a closer look at shrinking stock valuations in this market downdraft.

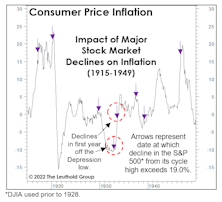

Stocks, Inflation, And Reverse Causality

Forget interest-rate hikes and quantitative tightening. There exists a very important weapon in the fight against inflation that the Fed did not have at its disposal in the 1970s: an overvalued stock market.

The Fed Was Not The Only One To Tighten Last Month

Wage inflation should accelerate in the months ahead, oil could bounce from its oversold low, and college textbooks might double in price before the fall semester. No problem…

The Line Of Least Resistance Is Lower

At some point in his career, famed stock trader Jesse Livermore ceased using the terms bull and bear, opting instead to describe trends in terms of “lines of least resistance.”

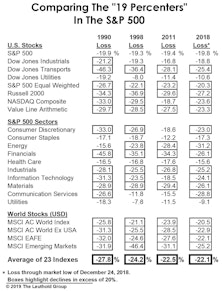

How This ‘Borderline’ Bear Stacks Up

The S&P 500 has again shown its mysterious ability to defy the conventional bear market threshold, with the decline into its Christmas Eve low becoming the fourth one in the last 30 years to halt just shy of the magic -20% figure.

Stocks Just Delivered A Strong Deflationary Impulse

Investors have just suffered a negative wealth effect that will likely work to tamp down inflation over the next year.

.jpg?fit=fillmax&w=222&bg=FFFFFF)