Market History

A Blast From The Past

With 2020 representing The Leuthold Group’s 40th year of publishing Perception For The Professional, we perused the first few Green Books for relevant nuggets from 1981, but the backdrop could not have been more different. Therefore, we instead turned the clock back 20 years, thinking it might yield insights more resonant with today’s environment.

A New Year, Or A Blast From The Past?

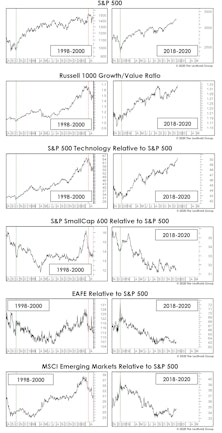

It was during the very first days of the great 2019 market rally that we noted its similarities to the bubbliest of all the bubble years—1999. Wow. We had it in our hands and frittered it away.

Closing The Books On Another “1999”

It’s been a while since we looked at 2019’s stock market parallels to 1999. Sorry about that… we’ve been too busy reliving 1999 on almost a daily basis, and often not in a good way.

Valuations: An Updated “Modern” Take

An occasional critique of our valuation work is that we consider “too much” market history to form a judgment as to what constitutes “high” or “low.” This type of feedback declined during and after the financial crisis (when historic valuation thresholds were temporarily revisited), but it has become more pointed as the U.S. market has soared to new highs.

Is There Any Perspective For Today’s Stock Market?

Eric Bjorgen searches for something beyond The Great Depression or 1990’s Japan. See what he found in this month’s Of Special Interest.

View From The North Country

Steve Leuthold revisits the 1987 stock market, and includes some excerpts of his commentary in the Green Book from the months leading up to the October crash. There are some stunning similarities to today’s market. Also, commentary on the current China stock market. Some have compared it to Japan in the late 1980s, but there are distinct differences.

View From The North Country

Steve discusses his opinion of market cycle sin this month’s “View From The North Country”. He is a believer in cycles, but not so sure about rhythmic cycles. Also, his thoughts on the importance of market history.

How Long To Catch Up?

Bear markets and the time to catch up.

Comparing the 1987 Stock Market Peak With Today

Recent market discussion has centered around comparisons of today’s stock market with 1987. In order to summarize the comparisons, we have put together a table containing over 30 factors that have stock market significance.

View From the North Country

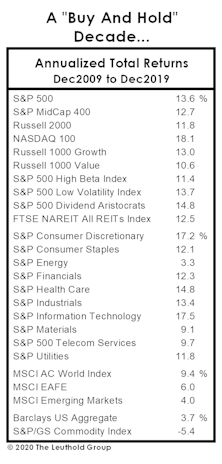

Should we just own stocks and forget about asset allocation? After all stocks have been the best performing asset class over the last 70 years.

Is It “Too Soon” For Another Recession?

I still hear commentators discussing the possibility of “another leg down” for the 1990 recession. In terms of past economic cycle analysis, this is impossible.

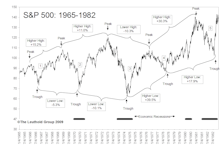

A Long Term Message Courtesy of Ned Davis

Ned Davis gave me this chart at the May Market Technicians Conclave in Naples Florida. It is a great chart, clearly making the point that today's stock market is overextended in terms of its historical performance history, not just in terms of valuation history.

Coming: The Golden Years for Stock Market Timing

On the evening of May 14th, Steve Leuthold was the keynote speaker at the 17th annual Market Technicians Association Seminar in Naples, Florida. What follows is a slightly edited version of his speech and the charts and tables used in a workshop on the following day.

.jpg?fit=fillmax&w=222&bg=FFFFFF)