Market Internals

Pause, Then “Paws?”

Despite the Fed’s tough-talk about getting the funds rate above 5%, monetary and liquidity measures are significantly less bearish. Thank SVB depositors, who required a bailout big enough to reverse five months of QT in just two weeks. The market reaction looks like that after September 2019’s Overnight Repo-market turmoil, which forced the Fed to end its first experiment with QT.

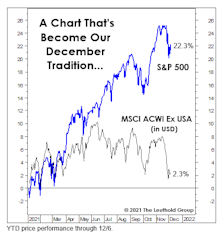

“Peak Insanity” Is Behind Us

We think 2021 has earned its place in the books as the wildest and most speculative year in U.S. stock-market history, eclipsing even 1929 and 1999. That doesn’t mean 2022 will bring a panic or a crash, maybe just a degree of sobriety.

Market Internals: Today Vs. Past Peaks

The table below compares the status of today’s stock market “internals” versus those which existed at the onset of (1) the past four U.S. bear markets; and (2) the two severe corrections taking place within the current bull market. There’s good and bad news here.