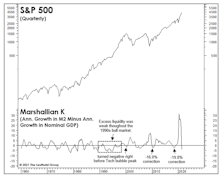

Marshallian K

The “K” Has Been “KO’d”

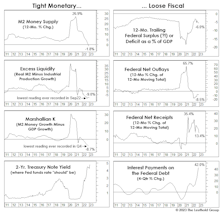

Volcker stormed to the scene to extinguish a blaze lit by others, while Powell battles a conflagration of his own making. Even if Powell executed a perfect, disinflationary soft landing, there may be something else in the cards: The magnitude of M2 shrinkage has resulted in the Marshallian K’s worst ever reading.

Inadvertent Easing?

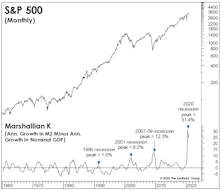

Sometimes, a sharp upside reversal in the stock market will correctly anticipate future improvement in monetary and liquidity conditions. That was the case with the powerful up-leg that sprang from the market’s 2018 Christmas Eve bottom.

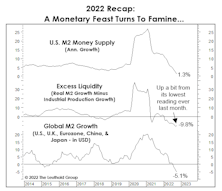

Illiquidity Rules The Day

Nearly everyone would cite high inflation as the dominant theme of 2022. But we think that the evaporation of a one-time ocean of liquidity better explains the horrendous backdrop for stocks and bonds. High inflation sped up the rate of evaporation, but it was going to occur anyway.

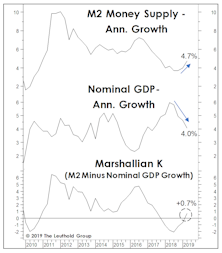

Economy Soaking Up Scarce Money Supply

There might be “too much money chasing too few goods,” but some monetary measures imply there’s “no longer enough money” to finance production of those goods and still support a stock market that’s far from cheap.

Interrupting The Recession Debate With A Reminder Of How Hot The Economy Is

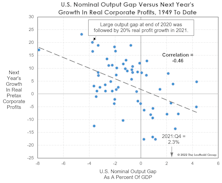

“Money illusion” continues to complicate analysis of the economy and financial markets. It might be a time when age and experience will actually prove helpful: Only investors who are 65 or older have experienced gaps between “nominal” and “real” data as wide as today’s.

“Gapping” Lower?

NIPA’s “all-economy” profit margin declined a bit in Q4—which typically peaks before SPX profits—and that falloff coincided with the economy officially reaching full employment, based on the CBO’s Nominal GDP Output Gap. When the Output Gap has flipped positive (like in Q4), corporate profit margins usually come under immediate pressure.

Liquidity Letdown?

Stock market liquidity might seem plentiful, with the Fed still buying $120 billion in bonds per month under the all-too-predictable continuation of what was first billed as an emergency operation. However, the steadiness of QE masks a major second-quarter reversal in “excess liquidity.”

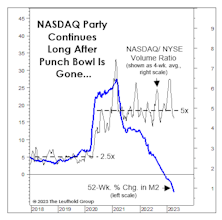

Sharing The Punch Bowl?

The gap between YOY growth rates in M2 and nominal GDP just flipped negative after four quarters of record-high readings. In other words, the recovering economy is now drinking from a punch bowl that the stock market once had all to itself. Similar drinking binges occurred in 2010 and 2018, both of which then experienced corrections north of 15%.

Liquidity: As Good As It Gets?

Stock market manias thrive on buzzwords, and if there’s a single one that captured the essence of the late 1990s’ boom it was “productivity.” In today’s version, our top candidate is “liquidity”—and we doubt anyone would argue.

Who Doesn’t Love “Excess” Money?

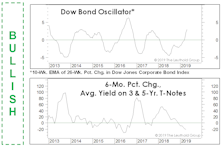

We’d concede the monetary backdrop for stocks is now mixed, an upgrade from the almost uniformly negative environment of last fall. On the negative side, the U.S. yield curve inversion has now persisted long enough that even the economic optimists are getting nervous.

Mixed Monetary Messages

Confidence in the U.S. economy’s health reached a new peak with the April employment report, with a blowout number for nonfarm payroll coinciding with a soft wage print.

It’s About Money, Not Profits

The consensus focus all year has been on the boom in U.S. corporate profits.

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.png?fit=fillmax&w=222&bg=FFFFFF)