Mega Caps

“PSsss”

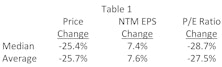

The most brutal bear markets occur when falling earnings are accompanied by shrinking valuations, producing a compound negative effect on stock prices. Investors in 2022 have (so far) avoided this double-whammy in that valuations have taken a hit, but EPS estimates are holding strong. We are intrigued by the notion that 2022’s bear market has, to date, been all about valuation compression rather than earnings weakness. Investors are coping with the problems of the day by letting the air out of bubbly valuations, and this report takes a closer look at the valuation squeeze underlying the current selloff.

Research Preview: P/E Multiple Compression In 2022

Stock market corrections are the result of falling valuations and/or falling earnings, and when both conditions appear together, investors are in for a rough ride. Thus far, the 2022 selloff has been confined to compressing P/E ratios, and we launched a research project to take a closer look at shrinking stock valuations in this market downdraft.

Big Time

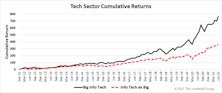

Market environments are driven not just by industry preferences, but also by a bias toward the very largest companies. We have developed a new set of groups composed of the 10 largest companies from each sector. With several of these baskets sporting positive rankings, we felt a closer look was in order.

The New FOMO

“Bull markets climb a wall of worry,” the old saying goes. We’ve heard that piece of wisdom (or imagined we heard it) every week since early summer. But we doubt it was meant to apply to today, when the paralyzing fear is not of potential loss, but of foregone upside (i.e., fear of missing out, or FOMO).

Is FANG Forever?

As mania surrounding Apple’s stock was reaching a fever pitch in early 2012, The Leuthold Group wrote a piece entitled, Apple, Just How High Can It Go? To those caught up in the hysteria, the article served as a cautionary reminder.

Running The Math On Mega Caps

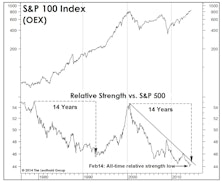

The recent move by the S&P 100 Index (OEX) above its historic March 2000 high prompted us to take a closer look at the turnaround potential of this perennially underperforming Mega Cap index. Remember, a Large Cap leadership cycle has been in force since April 2011—with the trend strengthening the last few months. What are the prospects for the biggest of the Big Caps?