MSCI USA Index

Party Like It’s 2029?

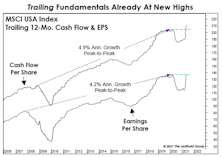

Trailing EPS that the Street now expects for the twelve months ending November 2022 would not have been achieved until November 2029 if the pre-COVID trend-line EPS growth rate had remained intact throughout the current decade.

Valuations And The Earnings Recovery

Analysts at Standard & Poor’s will soon confirm what’s been known for several months: The earnings downturn associated with the COVID recession was the shallowest and shortest of any recession-related EPS decline.

How It All Went “Down”

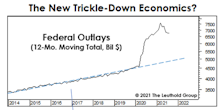

The COVID rescue plan has generated a multi-trillion-dollar deluge of federal spending that has trickled down to government transfer payments, personal incomes, retail sales, and surging EPS. When considering all of these data series in relation to their long-term trends, it’s truly remarkable that the only item analysts consider to be “transitory” is inflation.

The Earnings Recession Is History

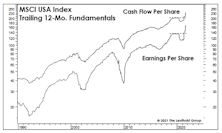

We expected that the earnings recovery from the shortest-ever U.S. recession would be the fastest on record. Trailing figures for the MSCI USA Index now confirm this: Trailing EPS and Cash Flow Per Share have surged to new highs only 14 months after their March 2020 peaks.

A Pricey Alternative To The S&P 500?

This month we focus on the valuations of the MSCI USA Index—which is nearly identical to the S&P 500. This is worth following mainly because the folks at MSCI are kind enough to provide us with much longer-term histories of Cash Flow and Book Value Per Share.