MSCI World Index

A Kind Word For “Forward Earnings”

Our criticism of the widespread trust in “forward earnings” has sometimes been harsh, but consider the following: the latest 12-month forward EPS estimate for the EAFE index is $122.71, virtually matching the forward estimate that was made in January 2006.

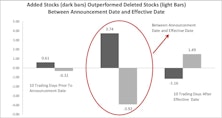

“Index Rebalance Effect” On Stock Performance

Stocks selected for inclusion in the MSCI ACWI have outperformed from the day of the announcement to the day of implementation, while the opposite is true for stocks which are removed. Long-term, however, stocks included in the index do not outperform compared to those that were removed.

A Quick Check On Global Fundamentals

The Street’s most clever invention is “12-month forward operating earnings” because the stock market invariably appears cheap on the basis of such inflated estimates.

The Dollar And Foreign Equities

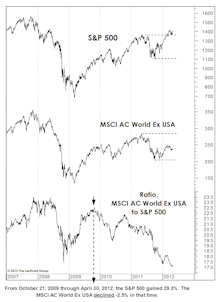

Xenophobia continues to be a handsomely rewarded trait for U.S.-based equity investors, with the MSCI World Ex USA Index down 3.8% YTD through December 3rd—and now (incredibly) unchanged from its May 2011 high. Comparable period gains for the S&P 500 are +12.2% YTD and +50% from spring 2011 highs.

U.S. Versus Foreign Stocks: More Of The Same

Long before the U.S. dollar began to rebound, the current bull market in global stocks had already favored “provincial” portfolio managers focusing solely on U.S. stocks.

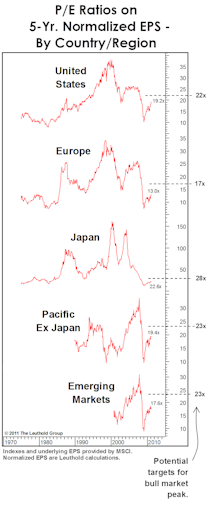

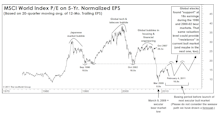

Global Valuations Rising, But U.S. Still At A Premium

The large valuation discount on foreign shares has narrowed a bit, reflecting better relative action in foreign shares over the past 14 months and relatively weaker foreign fundamentals.

A Comprehensive Look At The Emerging Markets: Diagnosis And Prognosis

We examine Emerging Markets from both the top-down and bottom-up perspectives as we try to identify where to move and what to expect. We check in on two successful EM thematic group ideas as well.

Time For A Breather

The Major Trend Index has been bullish throughout 2012, and the S&P 500 has delivered a total return of +12% through early August. Yet few managers have managed to match or exceed that benchmark, to do so, they would have had to be “fully invested and maximum defensive.”

No Place Like Home

How is the U.S. stacking up relative to foreign markets since 2009 market lows?

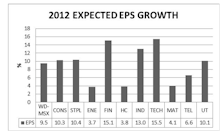

Global Perspective On 2012 Earnings, Sales, and Margins

Leuthold’s Eric Weigel dissects earnings, sales and margin expectations for the coming year.

Mid-Year Target Practice

It’s been quite awhile since we’ve engaged in target practice (... and considering my 20/300 vision, the world is a much safer place for it).

Valuations: The Good And The Bad

S&P Normalized valuations are already in the zone that have defined many important bull market tops.

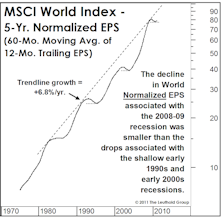

Smoothing Out The Cycle… And The “Psyche”

Fundamental rationales also have strong psychological elements. Normalizing earnings helps minimize the startling impact of declining earnings.

Global Valuations: Reverting To The Trough

From our perspective as disciples of Normalized EPS, the entire bull market to date has come from P/E expansion. However, that stands to change as global Normalized EPS are again on the rise.

Going (More) Global

MSCI Index very undervalued, as the recovery off the March 2009 lows has left valuations still near prior bear market lows. Relative to foreign markets, the U.S. looks expensive. This is why we continue to maintain a healthy exposure to foreign stocks…especially emerging markets.

Room For Global Earnings To Fall Further?

Even after a decline in global earnings of 46%, they could experience another 15% decline before reaching the bottom of the 40 year trend channel. It doesn’t look like last quarter’s stock market bottom means that an earnings bottom is imminent.

The Major Trend Index...Gone Global

Comparing and contrasting our traditional Major Trend Index and the Global Major Trend Index. Both are now Neutral, but the Global version is showing better valuations and worse technical scores.