MSCI

Emerging Markets EPS: There's Many A Slip...

If there is one thing sure to make equity investors swoon, it is the prospect of buying into a credible, long-lived secular growth story at a relatively modest valuation. Over the past three decades, Emerging Markets (EM) have proffered just such an opportunity. EM’s economic growth rates have far surpassed those of developed nations, and the valuations attached to EM stocks have often been at a discount to other markets.

However, this combination of secular growth and attractive valuations has not always paid off for investors. The MSCI Index has underperformed the U.S., Europe, and even Japan over the last ten years in local currencies. Furthermore, EPS growth for the EM Index has come in far below its economic growth rate, creating an exasperating drag on Index performance as it tries to keep up with other regions.

Research Preview: Emerging Markets’ Leaky Bucket

Investors view Emerging Markets (EM) as the best source of economic growth across global equity markets, and rightly so. Annualized EM GDP growth of 8.6% since 2001 is more than double that of the U.S. and Europe. However, investors have not captured this extraordinary advance because earnings per share for the MSCI EM Index have lagged far behind EM economic growth rates.

Emerging Markets: Down A Lot, But Not Really Cheap

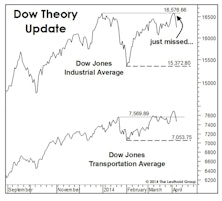

The stock market liquidity squeeze we’ve discussed this year hasn’t played out quite like we expected. Traditionally, Fed tightening and slowing money growth hit Small Caps earlier, and harder, than the blue chip stocks...

MSCI Reclassification: Winners & Losers

Market classification is an index rebalance on the country level and generally refers to shuffling countries among three baskets: Developed Markets (DM), Emerging Markets (EM) and Frontier Markets (FM).

“Index Rebalance Effect” Once Again Proven

Validating results of a prior study, a look at the last four MSCI index rebalances shows that stocks soon to be added outperform from Announce Date to Effective Date, while deleted stocks underperform.

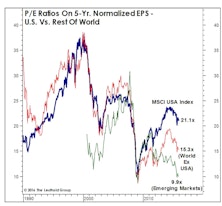

Foreign Stocks: The Value Trap Persists

Foreign stocks’ perpetual underperformance has opened up a valuation gap that should look extremely appealing to anyone with a horizon of more than two years. But proceed with caution.

Why Are EM Small Caps & Frontier Markets Outperforming?

Emerging Market investors are extending their “small” bet down to Small Caps and the Frontier Markets. We discuss potential reasons behind their outperformance.

U.S. Markets See Uniform Strength, While The World Seems Fractured

Based on the historical percentages, the bull market should have a minimum of four to six months of life left. But the market has a way of throwing sand in the gears when you think you’ve begun to understand its internal mechanics.

Market Valuation Check

Stocks have long looked expensive on the basis of dividend yield, but now they look increasingly stretched on Forward EPS.

The Bull Market Turns Five

The post-2009 stock market upswing now qualifies as only the sixth cyclical bull market since 1900 to last five years or more. But only three of the previous five-year-old bulls lived to see a sixth birthday.

Emerging Market Currencies: January’s Panic Overdone

The emerging markets are in a much better financial position to weather any financial turmoil than they have been in the past.

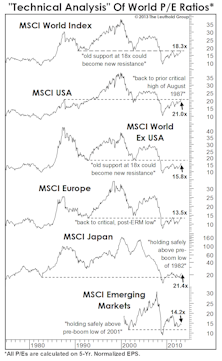

A Techno-Fundamental Take On The World

At 15.8x Normalized EPS, the non-U.S. developed world (measured by the MSCI World Ex USA Index) still hasn’t managed to recover to its old lows of 18x seen in both 1992 and 2002.

Thirty Percentage Points Of Pain…

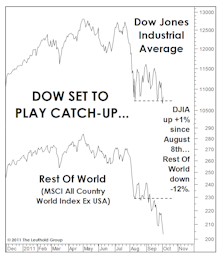

The S&P 500 is now up 30% from last year’s October 4th low - a rally that surely ranks among the least enjoyable and least exploited gain of that magnitude in history.

Stay Bullish

It’s April once again… Are we due for yet another market top? Some perspectives on the possibility of attaining a new all-time market high in the current cyclical bull, and what may drive the upside.

Worse Than It Looks… And Not Over

Most costly market decoy in the last six weeks has been unusual (relative) strength of the Dow and S&P 500 indexes. Resilience in blue chips is characteristic of the early and middle phases of a bear market, but recent blue chip performance has been so stellar (again, in a relative sense) that most investors curled up comfortably in the “correction” camp…while small caps, cyclicals and virtually all foreign markets were screaming “BEAR!”

The Charts Of The Year

This month’s “Of Special Interest” takes a look back at and updates some our favorite charts from 2010.

Expect Foreign Stocks to Continue to Outperform U.S. Stocks in this Bull Market

Superior performance of foreign stocks of late is likely only the preamble to what the rest of the cyclical bull market will look like.

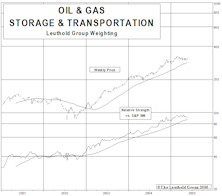

Examining the Recent S&P/MSCI Global Industry Classification System (GICS) Changes

Standard & Poor’s/MSCI did their annual review of the GICs groups and made some changes...in a few cases adopting groups we had already established at The Leuthold Group and had been tracking for several years. This month’s “Of Special Interest” discusses the changes and presents our take on the new groups.

.jpg?fit=fillmax&w=222&bg=FFFFFF)