New Era

Reversion, But To Where?

The concept of “mean reversion” used to help build massive fortunes. Of late, a better mantra has been “maximum attraction,” as valuations and bullish psychology have matched or surpassed excesses of the Y2K Tech bubble. Meanwhile, corporate profit margins, once dubbed “the most mean-reverting series in finance” by Jeremy Grantham, have now topped those seen near the Y2K top by more than 50%.

Even “True Believers” Should Read This

Consider it a sign of the times: Here is the most bullishly slanted version of our “Estimating The Downside” exercise we’ve ever put in print (and likely ever will).

New-Era Profits, New-Era P/E Multiples

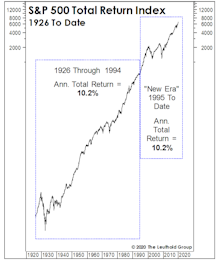

The current mania won’t last forever. But our use of the “New Era” label in describing the last-quarter century or so of stock-market dynamics is still useful—in part because it highlights fundamental developments that simply cannot be repeated indefinitely.

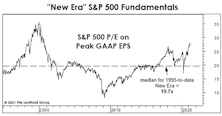

New Era Valuations?

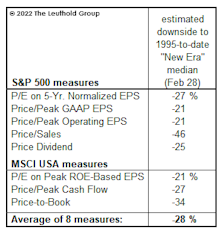

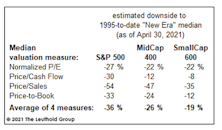

We understand the various rationale for the upward shift in equity valuations seen over the last quarter century or so. Unfortunately, wiping away all market history prior to 1995 does not make stock valuations appear significantly less inflated.

A “New-Era” Look At The Future

Young readers sometimes give us a not-so-subtle roll of the eyes when we discuss any sort of stock market history that occurred before their date of birth, but it takes experience to appreciate that “there’s nothing new under the sun—least of all in the stock market.”

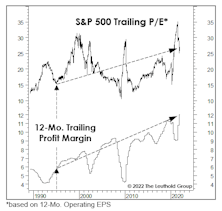

Superhuman Feats Got Us Here

The simultaneous “New Era” ascension in margins and P/E ratios hasn’t generated anything exceptional from a return perspective. To the contrary, annualized S&P 500 total returns over this 25-year period of margin magic and (mostly) escalating P/E ratios merely match “Old Era” returns.