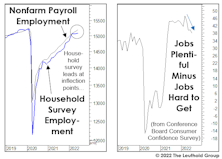

Nonfarm Payroll Employment

Labor Market Begins To Labor...

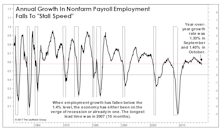

Most labor market measures continue to weaken, and for investors still heavily invested in stocks, we’d caution against waiting for all labor market figures to deteriorate before scaling back. Equities will likely take a big dive before such conclusive evidence arrives.

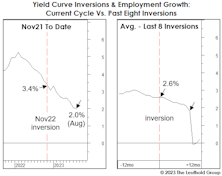

Job Market Deja Vu

With leading economic measures still trending down, optimists who advocated against fighting the Fed during the free-money era have ditched their own advice. Their focus is now on lagging indicators, like the employment numbers—but that last bastion of strength seems ready to buckle.

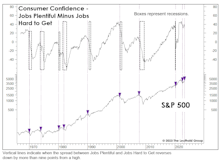

Even The Labor Market Looks Recessionary

We think the stock market is skating on pre-recessionary thin ice, an endeavor that, admittedly, can be both irresistible and (temporarily) profitable.

Job Market Suddenly “Laboring”

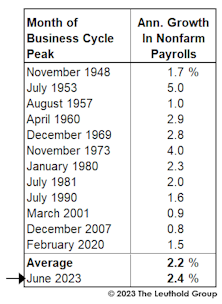

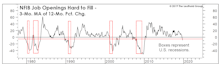

We cringe when we hear the Treasury Secretary or a regional Fed bank president dismiss the possibility of recession on the basis of “low unemployment and strong job gains.” Those measures are as “laggy” as any economic statistics the government publishes.

Lagging From Behind?

As Yogi Berra might have quipped, it’s not just the leading indicators that are lagging… the lagging ones are, too.

Below “Stall Speed”?

The last few months have served up some of the strongest readings observed during the U.S. economic expansion.