Normalized P/E

A G-Rated Take On Valuations

In the wake of the 2020-21 mania, any dose of valuation sanity is obviously greeted with eye-rolls. We are going out of our way to present the numbers in the least-shocking way possible.

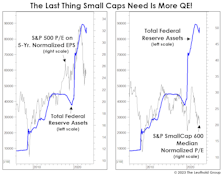

QE Fuels Inequality—Even Among Stocks

We don’t know enough about banking-system mechanics to conclude if the Fed’s balance-sheet increase associated with March’s bank bailout constitutes a new round of QE. But if it is, we’re skeptical equity investors should celebrate it. In fact, those running Small-Cap portfolios should probably fear it!

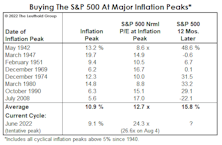

In The “Eye” Of The Beholder

Stocks could trade higher in the next few months as CPI numbers enjoy easy year-to-year comparisons, prompting a more soothing tone in daily Fed-speak. Then again, the lagged impact of the last year’s rate hikes and balance-sheet shrinkage has yet to materialize, meaning we’re likely in the eye of the storm.

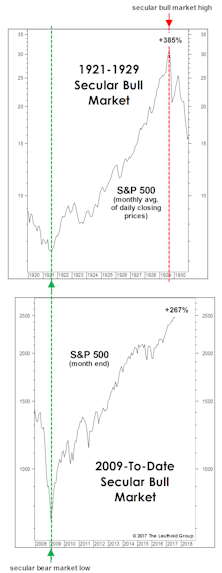

A One-Hundred-Year Market Echo

Hopes that this decade might see a repeat of the “Roaring Twenties” took a hit last year. But there’s plenty of time to recover, and bulls will be encouraged to learn that cumulative stock market performance for this decade, thus far, is better than at the same point in the Roaring 1920s.

Thoughts On The Secular Outlook

Some have speculated that 2022 might have been the kick-off for a decade-long era in which the broad stock market indexes will make essentially no progress, like 1966-1982. However, that earlier experience provided opportunities within other market segments, which will also stand a much better chance in coming years.

A Valuation Check-Up

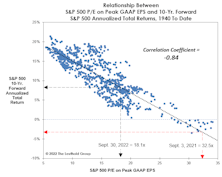

The P/E multiple on Trailing Peak GAAP EPS has plunged 44% from its year-ago peak of 32.5x. The current ratio of 18.1x is below its “New Era” median (1995-to-date) —but some conditions characterizing the New Era no longer apply.

Time To Retire The Fed Model?

We’ve heard no references lately to the famous “Fed Model” for stock market valuation. We think we know why: The model’s usual proponents probably don’t like its current verdict—which is that stocks are far more expensive than at the early January market peak.

Valuations: Living Beyond One’s Means?

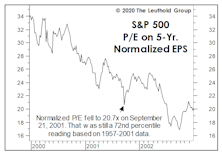

We won’t dispute that investors were not genuinely frightened at the June market lows, or that fears have evaporated following a 13% rally in the S&P 500. The distress is understandable: For 26 traumatizing days in 2022, our S&P 500 Normalized P/E multiple traded below its 1957-to-date top decile!

Normalize This!

The sell-side is at it again, publishing a one-year ahead “Adjusted” EPS figure for the S&P 500 that is unlikely to be achieved—and then affixing P/E multiples seen near an historic market peak to “capitalize” on those unlikely earnings.

What If It’s Just A “Median” Bull?

Last spring and summer, we were incorrectly skeptical that a new bull had been born only five weeks after the death of oldest bull ever. But be careful with labels. Just as the “bear market” mindset caused us to overplay our hand last spring, equity bulls should not assume the current bull will look anything like the decade-long affairs we’ve seen twice in the last 30 years.

Super-Rarified Air

The 2020 post-election stock surge looks and feels a lot like the 2016 “Trump Bump.” But, of course there’s a spoiler. The Biden Bump started with a Normalized P/E level about 30% higher than the one prevailing on election eve of 2016 (26.8x versus 20.5x, respectively).

Does An Economic Rebound “Inoculate” The Stock Market?

The 2020 decline exhibits a strong resemblance to the “incomplete” bear market of March 2000-September 2001—in that neither decline sufficiently deflated the extreme valuations of the preceding bull, and each was followed by an immediate rebound in reliable valuation measures to top decile levels.

Implications Of The “Breakout”

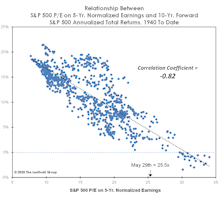

July’s developments led to us investigate the market valuations accompanying all past month-end S&P 500 breakouts which (1) eclipsed the prior month-end bull market high; and (2) made a new all-time high in the process.

It’s Demographics, Stupid! (Not The Economy.)

Turn on financial television at any random time, and you’re likely to soon hear the argument that still-high U.S. stock market valuations are “justified” by extremely-low interest rates. We’ve countered that these low U.S. rates are simply a reflection of the secular slowdown in economic and earnings growth.

“Normalizing” For The Earnings Collapse

Stocks (and more specifically, U.S. blue chips) did not fully (nor even approximately) discount the economic calamity. The result is that, in just over two months, the “baby bull”—if that’s what it is—has achieved what took his legendary predecessor more than eight years to accomplish: Top 25x on our Normalized P/E.

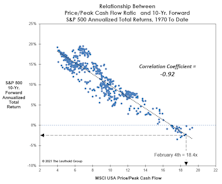

Calculate The Next Low... With The Last Peak?

How does one value a stock market in which 12-month forward EPS estimates show their widest dispersion in history? A good start might be with methods we use when forward estimates show practically no dispersion (like three months ago). In either case, we place little weight on such estimates; each revision usually has only marginal impact on our 5-Year Normalized EPS.

The Stock Market Is Trading Like Trump’s A Democrat!

Around the time of Donald Trump’s inauguration in January 2017, we observed that prevailing valuations argued against him witnessing big stock market gains during his first term.

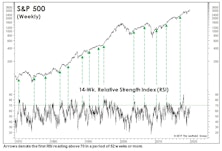

How Much Should We Pay For Market Momentum?

If the S&P 500 closes in the green today, an RSI "overbought" signal will be triggered.

The Small Cap Discount Deepens

Small Caps typically underperform during a bull market’s final phase, and our findings with respect to the Output Gap aid our understanding of that phenomenon.

Assessing The Cyclical Risks

With all the excitement over the Fed’s shift in rhetoric and the excellent subsequent market action, there’s a danger of losing sight of the broader cyclical backdrop for U.S. stocks. Remember, the economy is still operating beyond government estimates of its full-employment potential, and it’s not as if the Fed has actually eased policy—as it did successfully at a similar late-cycle juncture in the fall of 1998 and (ultimately unsuccessfully) in the summer of 2007.

The Trump Trade, Two Years In

Donald Trump is thought to have been born with a silver spoon in his mouth, and the economic circumstances prevailing at his inauguration two years ago might have further perpetuated that view. The U.S. economy had already been in recovery mode for 7 1/2 years, and the bull market in U.S. stocks was about to celebrate its eighth birthday.

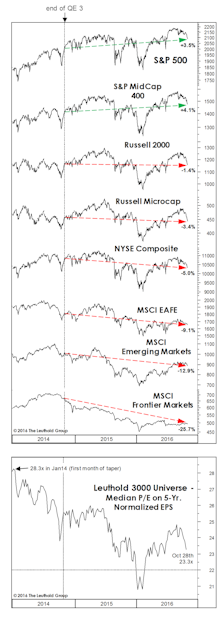

The Downside Leaders Look Familiar

It wouldn’t be a December Green Book without at least one page of hand-wringing over the year’s extreme underperformance of foreign stocks.

Emerging Markets: Not Persevering, Just “Preserving”

We’ll never know how world events might have evolved had Mitt Romney won the presidential election in 2012. But thanks to the wonderment of Emerging Markets’ underperformance, we can go right back to the last days preceding that fateful election.

The Two-Tiered Global Market

We should emphasize that our characterization of stocks as dangerously overvalued applies only to the U.S. market.

Foreign Stocks: What Will Turn The Tide?

After a brief respite last year, EAFE has reverted to its old form by falling 300 basis points behind the S&P 500 so far in 2018. EAFE’s main transgression might simply be that it represents good relative value in a market that’s been rewarding only momentum...

Leverage Factor: A Boost For High Quality Stocks?

A review of Quality factors, as well as the lower valuations of High Quality stocks, supports the current High Quality cycle amid rising market volatility. The Leverage factor may provide particularly strong backing for High Quality stocks.

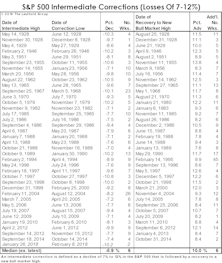

Nine Corrections In Nine Years

The stock market’s nine-day decline off its January 26th high met our definition of an intermediate correction—an S&P 500 loss of between 7-12%.

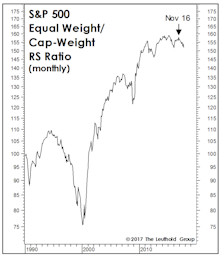

Cap Weight Or Equal Weight?

The Equal Weighted S&P 500 now trails the S&P 500 by 400 basis points YTD, and the rally is increasingly assailed as too narrow.

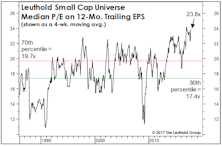

Small Cap Valuation Check

We don’t have a strong capitalization-bet recommendation, other than to remind readers that Small Caps have been especially responsive to the favorable seasonal window that began November 1st (and which extends through April 30th).

Could It Be A “Two-Fer?”

The milestones achieved by the current cyclical bull market have been so numerous that we hope you’ll forgive us for missing one back in May.

America’s Already First...

Thanks to the U.S. dollar’s recent spike, foreign equities in dollar terms declined during November while the U.S. markets were celebrating a Trump victory. Thirty-nine of the 49 MSCI country indexes are in bear market territory from the perspective of a dollar-based investor.

Has The Fed Already Hit Stocks?

One never appreciates what he or she has until it’s gone. In our case, during the many years it was freely available, we failed to appreciate the zero interest rate. Now that it’s gone, we already feel pressured to join a game where we (and very few others) have any edge: Fed-watching. Our real edge is that we recognize this.

Low Quality Dominance Since March

After two rough months moving into 2016, Low Quality stocks rallied and are now leading High Quality stocks YTD. Investors apparently brushed-off the slowdown scare from China, and later the Brexit headlines.

Small Caps: The P/E Premium Lives On…

Small Cap valuations may look better on a relative price-to-book basis, but we still believe their Normalized P/E ratios will suffer further compression before Small Caps reclaim the leadership baton.

The Bullish Case: A Mental Exercise

We’ve been correctly positioned near our tactical portfolios’ equity minimums, yet we’re oddly compelled to use this month’s “Of Special Interest” section as a very public second-guessing of that move.

Small Cap P/E Ratios: Not Yet Low Enough

When the Fed surreptitiously began to tighten as we believe (via tapering), in January 2014, history suggested that Consumer Discretionary and Small Caps would be the most likely initial market victims (at least from a relative perspective).

Valuations: The Bad And The Good

Foreign valuations experienced nowhere near the expansion enjoyed by U.S. stocks during the latest bull market, but their cheaper valuations rarely seem to inoculate them from outsized losses during corrections and bear markets.

The EM "Trap"

Minding The Gaps

We think stock market action in the next few months will provide the Fed with an excuse to skip any rate increase in 2015. But our view is a minority one, and futures’ market odds on a September increase shot up in early August. Either way, the obsession over the timing of a Fed rate hike ignores the fact that world P/E ratios are already contracting—at least on the basis of our 5-Year Normalized EPS.

Emerging Markets: A Half-Off Sale!

The Chinese government’s repeated stock market intervention attempts over the past several weeks have been remarkable, and obviously antithetical to the country’s move toward a more laissez faire corporate environment.

.jpg?fit=fillmax&w=222&bg=FFFFFF)

_Page_1.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)