Operating Margin

Marg-flation

The 2022 bear market will be remembered as a year when collapsing growth stock valuations and rising interest rates doomed almost every asset class to return purgatory. Hopes for avoiding a second down year rest with a potential top in interest rates and solid earnings underpinning the stock market. Wall Street strategists have a year-end 2023 price target of just over 4,000 for the S&P 500, a few percentage points of upside from today but hardly reason to toast a prosperous new year.

Research Preview: Inflation And Margins

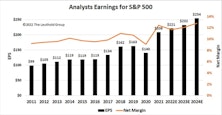

A new study looking at the relationship between inflation and profit margins is introduced. The goal is to understand how the latest margin peak was reached in mid-2021 and what impact inflation might have on margin forecasts underlying next year’s earnings estimates. Full report will be sent mid-month.

Earnings Expectations: The Bear’s Other Shoe

To paraphrase that great market historian Leo Tolstoy, “each bear market is unhappy in its own way.” Recession, interest rates, valuation bubbles, inflation, war, credit cycles, oil prices, manias & panics: the tipping point that triggers each bear market is always different. However, bearish forces ultimately manifest themselves in just two ways; declining earnings and/or declining valuations. June’s Of Special Interest report detailed how the current bear market has been fueled entirely by collapsing valuations, with the largest P/E compressions occurring in companies with the highest starting valuations.

Research Preview: The Impact Of Falling Estimates

The 2022 bear market has been driven entirely by a collapse in P/E ratios. Last month, we noted that the other potential driver of market declines—falling earnings—had yet to raise its ugly head. Now we examine past episodes to consider how the stock market might react when the “other shoe” (EPS) drops.