PPI

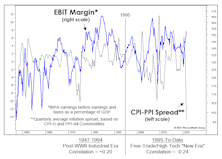

Marg-flation

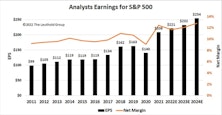

The 2022 bear market will be remembered as a year when collapsing growth stock valuations and rising interest rates doomed almost every asset class to return purgatory. Hopes for avoiding a second down year rest with a potential top in interest rates and solid earnings underpinning the stock market. Wall Street strategists have a year-end 2023 price target of just over 4,000 for the S&P 500, a few percentage points of upside from today but hardly reason to toast a prosperous new year.

Research Preview: Inflation And Margins

A new study looking at the relationship between inflation and profit margins is introduced. The goal is to understand how the latest margin peak was reached in mid-2021 and what impact inflation might have on margin forecasts underlying next year’s earnings estimates. Full report will be sent mid-month.

Market Gets A Speeding Ticket

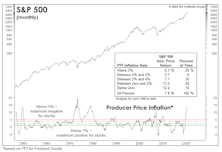

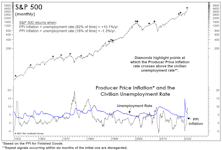

PPI and CPI inflation reached levels that were “too hot to handle” last April and July, respectively, yet the blue chips kept going up through year-end. Large Cap investors who trimmed stocks in response to the violation of these long-time inflation speed limits, however, haven’t missed out on much, and Small Cap investors who did so are happy.

A Marginal Measure Of Margins?

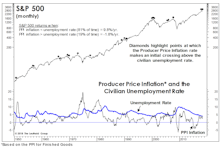

For those believers in a new economic- and stock-market era, there’s good news. The CPI-PPI spread has not been an effective proxy for profit margins during the 1995-to-date “New Era.” But, the failure of an inflation measure during a mostly non-inflationary era shouldn’t come as a surprise.

The Inflation Surge In Context

Inflation is already “too high” for the current cyclical setting, and the level of inflation that equity investors are willing to tolerate will drop further as the economy recovers.

Music For The “Mania”

At some point during the June/July streak of seven-consecutive S&P 500 daily-closing highs, an album from 1980 popped into our heads: Nothin’ Matters And What If It Did—released when John Mellencamp was still known as John Cougar. It brought to mind some “nothin’s” that seem not to matter.

Inflation Watch

April ISM readings, both for Manufacturing and Services, were hot across the board. That’s good news for a still-recovering Main Street, but it manifested in ways that have frequently caused problems for a famous Street located in Lower Manhattan.

How Much Inflation Is Too Much? It’s A Moving Target

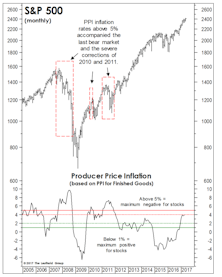

In the latest Green Book, we noted that Producer Price Inflation does not usually become a challenge for the stock market until its annual rate breaks above 4.0%. The day that comment was published, the year-over-year gain in the March PPI for Finished Goods spiked to 6.0%, thanks mostly to the well-celebrated COVID-19 anniversary-effect.

Still Heating Up…

The Fed’s reflationary efforts are showing up everywhere except in the measure that’s engineered specifically to minimize them—the Consumer Price Index. It’s a virtuous circle, until it is not

Inflation Warning Flags?

After yet another benign figure on wages for June, the idea that inflationary pressures might be a problem for the stock market seems far-fetched.

Full Employment And Rising Prices Aren’t Stock-Friendly

Annual Producer Price Inflation rose to 4.0% in May, a key threshold above which the S&P 500 has historically delivered essentially flat returns. But the fact that this reading occurs against a backdrop of full employment is cause for even more concern. Context is key...

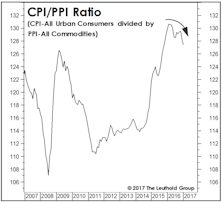

Keep An Eye On “Relative” Inflation

While our Group Selection (GS) framework hasn’t yet warmed up to commodity-oriented industries, our macro work suggests perhaps it should.

Inflation Complacency?

Leading inflation indicators have leveled off so far in 2017 after last year’s huge rebound from the deeply oversold readings produced by the 2014-2015 collapse in commodities.

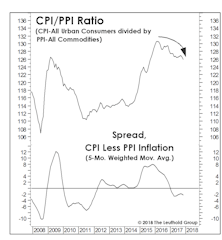

Lo And Behold, Another RATIO!!

For managers who must remain fully invested in equities (or “paid to play,” as we’ve often called it), the level of inflation might prove a less important consideration than its character.

Could Inflation Threaten The Stock Market?

Over the last 70 years, stocks have made no cumulative progress when Producer Price Inflation runs above 4%. Returns have been average when PPI inflation runs between 2% and 4%—where it is today.

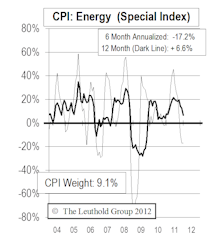

Inflation—Expecting More Drag From Oil

With the recent weakness in oil prices and the renewed strength of the U.S. dollar, we would not be surprised to see weaker headline numbers in the next few months. The expectations of a rate hike might actually end up pushing the rate hike further out. We are now less sanguine about a pick-up in PPI in the rest of the year.

Another Take On The Inflation Debate

While there’s understandable obsession over the likely level of inflation (especially with the year-over-year CPI dipping below zero in the past two months), equity managers with no interest or skill in inflation forecasting might be better served by monitoring the character of inflation—i.e., whether it was led by changes in consumer or producer prices.

Inflation Pressure Anemic

Inflation measures are broadly in line with expectations, and overall inflation pressure is anemic. We maintain our view that inflation will be a non-factor in the first half of 2014, and it might increase moderately in the second half. Inflation on the producers’ level is weak, too and the PPI inflation pipeline doesn’t seem to pose any immediate inflationary threat either.

Inflation Lower Still

We maintain our view that inflation will be a non-factor for the next six months but will increase moderately in the following six months.

Inflation Still Going Nowhere In The U.S.

Inflation at both consumers’ and producers’ level is still modest. A drawn out government shutdown and debt ceiling debate will hurt the economy, which could further push out the taper timeline.

10-Year: Taper the Taper—Upside Limited

If interest rates keep going higher from here, we would run the risk of derailing a still-fragile recovery. As long as the Fed tapering uncertainty exists, we expect higher volatility on the 10-year yield to persist in the mean time.

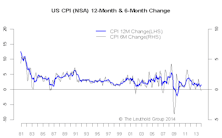

Inflation Slightly Lower Than Expected

The non-seasonally adjusted CPI fell 0.5% from October to November, lower than expected.

No Big Change — Inflation Remains Moderate

The non-seasonally adjusted CPI was essentially flat in October, in line with market expectations.

Inflation Turned Higher In August

The non-seasonally adjusted CPI jumped 0.6% in August, matching the market consensus.

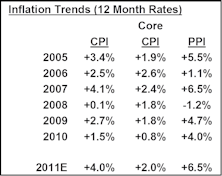

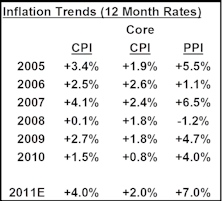

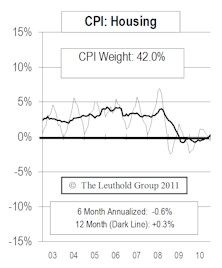

Reported Inflation Should Be Muted In 2012

For 2012, the reported CPI is expected to slip down to the +2% area (although items like lunches, transportation, parking and food may continue rising at close to a 10% rate).

Falling Commodity Prices Tamping Down Inflation Pressures

Through November, the CPI is now up 3.4% from year ago levels, while the PPI is up 5.7%.

Very Little Price Pressure At Present

It is very difficult to find signs of accelerating inflation in today’s markets.

Inflation Pressures Waning

While our 2011 year end inflation projections are still well above the 2010 year end levels, it seems that both the CPI and PPI may have already peaked for the year.

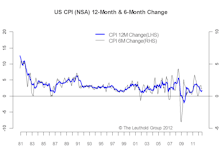

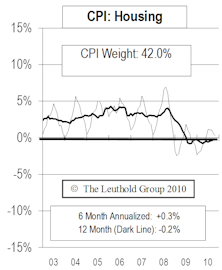

Six Month Readings Look More Favorable Than Twelve Month Readings

In all of the primary inflation measures monitored in our Inflation Watch publication, the six month rates of change moved lower in July. For the most part, the twelve month readings have continued to rise. This action is likely pointing to diminishing inflation pressures for the months ahead.

Jumped The Gun With Boost To PPI Estimate

The July reports showed that both PPI and CPI edged downward in June from May readings.

Inflation Pressures Continuing To Heat Up...Boosted Year End Projections

CPI rose 0.5% in May (before seasonal adjustments), down from April’s +0.6% monthly increase.

Despite Falling Commodity Prices, Inflation Still Expected To Accelerate In 2011

Latest PPI month/month increase was +1.2%, however the latest report is a measure of inflation from mid March through mid April and does not include the impact of the plunge in commodity prices.

Inflation Pressures Becoming More Evident

All three PPI measures have their six month rates of change well above the 12 month rates, so the trend points toward even higher inflation ahead.

Inflation Pressures Becoming More Evident

All three PPI measures have their 6 month rates of change well above the 12 month rates, so the trend points toward even higher inflation ahead.

Inflation Acceleration In 2011

By keeping interest rates at extreme lows and printing money, the Fed is trying to reflate, convincing consumers to spend, not save and investors to buy riskier assets.

Inflation Acceleration In 2011

Commodities are on fire, and it’s not just because of the weaker dollar. Commodity prices are signaling significant pass-through inflation pressures building.

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)