Price Volatility

Earnings Are Back In Focus

Earnings releases (ER) are normally accompanied by large stock-price movements, either to the upside or downside.

Here, we computed the percentage of companies that registered a large move in their stock price on their ER day in the trailing three-month window (500 basis points up OR down). In order to normalize for non ER-day volatility, we computed the percentage of all companies that registered a significant price move on any day during the same period. The difference between the two is shown in Chart 1.

Earnings’ Lost Relevance

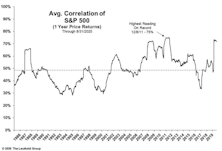

One characteristic of recent stock market action is extreme correlation. Chart 1 shows that during the sharp market decline following the COVID-19 arrival in the U.S. and the V-shaped upturn thereafter, the average correlation of S&P 500 constituents moved to near its highest level measured back to 1986.

.jpg?fit=fillmax&w=222&bg=FFFFFF)