Prices

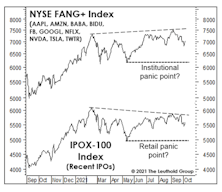

How It Is—And Isn’t—Like Y2K

We previously promised to limit the amount of comparisons to Y2K, but the paths that a number of the usual suspects are taking look more and more like “something we’ve seen before”—in some cases down to the percentage point.

How It Is, And Isn’t, Like Y2K

The 2022 economic backdrop is nothing like the near-Goldilocks environment accompanying the first few innings of the Y2K Tech bust. However, the action to-date in the former Growth stock leaders has followed the 2000-2002 path very closely—and almost on a point-for-point basis, when it comes to some indexes. With the stock market “weight of the evidence” still negative, we wouldn’t be surprised if the Y2K analog holds for a while longer.

Are Price Hikes The “New” Rate Hikes?

Notwithstanding the hit to consumers’ pocketbooks, it’s been amusing to follow the Fed’s recent evolution with its mindset regarding inflation. A year ago, the hope was for “symmetry”—Fed-speak for allowing inflation to run above its long-time 2% target, since it had previously undercut that level for awhile. Then, early in 2021, the word “transitory” entered the lexicon; yet months of debate and tens of thousands of utterances on financial television have clarified nothing about the Fed’s characterization of that term.

Deep Thoughts On The Recovery

Massive gains in stock market wealth have undoubtedly been a contributor to inflation, yet few analyses of the inflation picture even mention the stock market—other than to predict it will soar when inflation proves transitory.

A 40-Year Inflationary Echo

When measured by the gains in stocks, gold, and house prices, there has been just one other occasion in which asset inflation was as “broad” as today—late 1980. But the differences in underlying fundamentals between then and now couldn’t be more stark.

European Banks: Buy Low…?

As steadfast believers that “price paid” is a major determinant of an investment’s risk and return, we snap to attention whenever we hear that an asset is selling at a multi-decade low.

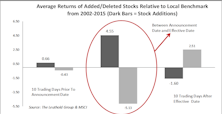

Index Rebalance Effect—A Disappearing Anomaly?

In the past we’ve made the observation that adding/deleting stocks to/from a popular index can have a profound impact on the target stocks’ short-term trading volume and performance.

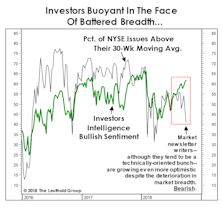

Investor Temperament And The “Tape”

In the first week of October, the share of newsletter bulls topped 61% just as the NYSE percentage slid to 41%. Maybe it’s a seasonal thing… the last time that happened was October 2007.

Watching Prices And New Orders

Trying to monitor the dozen or so regional purchasing-managers’ surveys released prior to the monthly national report invites a perpetual case of whiplash...

Too Calm For Comfort?

Is stock market volatility so low that it’s a bad thing? For volatility sellers, the answer is an unequivocal yes. But for stock market investors, the answer isn’t so clear.

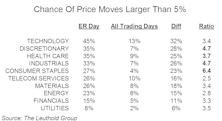

Calendar Effect On Earnings-Release Day Price Movement

Earnings season is not only important for fundamental investors, it can be equally so for quant managers. For quants that incorporate fundamental data, like us, historical trends and changes in consensus estimates may weigh heavily on model output.

Earnings-Release Price Movement Among Sectors/Industries

Earnings season is not only important for fundamental investors, it can be equally so for quant managers. For quants that incorporate fundamental data, like us, historical trends and changes in consensus estimates may weigh heavily on model output.

Guidance & Price Movement On Earnings-Release Day

We study the effect of company guidance on ER-day price volatility. Do companies issuing more frequent and detailed guidance help to prevent big surprises on ER day?

Puzzling Trend Of Earnings Release Price Impact

The ER price impact has shifted higher post 2008-2009 financial crisis, and the movement has been more pronounced in the Small Cap universe. A look at analyst coverage and accuracy of estimates.

In The Volatility “Sweet Spot”

Market anxieties have inched up over the last several weeks despite the proximity of all major indexes to cycle highs. The MTI’s Attitudinal category has improved by about 70 points in the past few weeks, and we sense more worry than usual over potential for turmoil in the seasonally-weak months of September and October.

Confidence & Stock Prices

We’re still bullish, but nonetheless feel a duty to take issue with some of the popular story-lines that have attended the past two years’ rising prices.

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)