QE

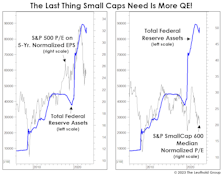

QE Fuels Inequality—Even Among Stocks

We don’t know enough about banking-system mechanics to conclude if the Fed’s balance-sheet increase associated with March’s bank bailout constitutes a new round of QE. But if it is, we’re skeptical equity investors should celebrate it. In fact, those running Small-Cap portfolios should probably fear it!

A Failure of "Free Money"

Senator Rand Paul’s annual “Festivus” report on wasteful spending makes for sobering reading to the dwindling few who care about federal finances. The “low light” for 2021 was a $465,000 grant to the National Institute of Health for a study of pigeons playing slot machines.

“Memes” Need Money Growth...

The extra months of QE “auto-pilot” failed to support some of the themes we’d have thought were the most likely to benefit from it—including IPOs, SPACs, Bitcoin, and the sky-high growers favored by the ARK Innovation ETF. Instead, the smart play with each of these assets was to ignore the ever-expanding Fed balance sheet and sell in February.

A Good Thing To Have In Reserve

It seems investors care mostly that the authorities have fiercely defended the S&P 500’s status as the World’s Reserve IndexTM. A decade of QE should have taught us that when the Fed conducts a decade’s worth of QE in little more than a year, U.S. Large Cap stocks benefit the most.

Policymakers’ Shell Game

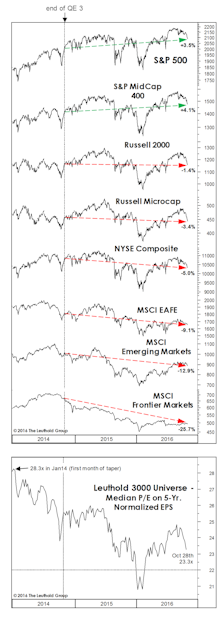

We considered the launch of the QE tapering program in January 2014 as the formal onset of the Fed’s tightening campaign, and that view seemed to be on the mark when High Yield bonds, and then stocks, unraveled over the next couple of years—although the final losses in the DJIA and S&P 500 fell short of what we expected.

Has The Fed Already Hit Stocks?

One never appreciates what he or she has until it’s gone. In our case, during the many years it was freely available, we failed to appreciate the zero interest rate. Now that it’s gone, we already feel pressured to join a game where we (and very few others) have any edge: Fed-watching. Our real edge is that we recognize this.

The Policy Conundrum

Over the last eight years, policymakers around the world have held interest rates at unimaginably low levels, run persistently large fiscal deficits, and (in some cases) engaged in outright money-printing via quantitative easing programs.

End Of The QE Trade? Too Early To Call

The common driver behind the sharp reversal of many recent asset class trends is the unwinding of the ECB QE trade.

EU QE - Success Highly Uncertain

We rely on past experiences in Japan, the U.K., and the U.S. to give us clues about the future path of the EU QE.

QE Success Limited - A Transmission Channel Check

Perhaps the most important is the credit channel; the substantial curve flattening that happened recently in anticipation of the Fed hike next year has made lending standards tighter for small businesses.

Current State Of Stock-Bond Relationship = “Easing”

We define four states of the stock-bond relationship based on the directions of stock price and bond yield movements; stocks fear tightening more than true risks, while bonds are more responsive to Risk-On and Risk-Off.

A Year Before Tightening - Stocks Will Be Fine

We studied the five previous initial rate hikes and present the average pattern over the one year period prior to these events.

QE: The Third Time Is The Charm

Five springs ago, we couldn’t have imagined we’d still hold near-maximum equity exposure after a near-tripling in the stock market from its Great Recession low. Then again, we wouldn’t have guessed that Fed printing presses would still be whirring so many years after the crisis ended. Coincidence? Probably not.

Have We Seen This Post-QE Movie Before? It’s Still Too Early To Call

We looked at the periods around the end of the three previous easing programs (QE1, QE2 and Operation Twist) and compared those patterns with the current ones for various measures. The current patterns from both an economic and a market front bear enough resemblance to the previous ones to make us a bit uncomfortable. February’s market action was encouraging, but it is still too early to rule out a post-QE fizzle.

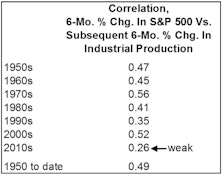

Stocks And The Dismal Science

Has recent Fed experimentation compromised the stock market’s “social function” as an economic forecasting tool?

No “Pop,” Just A “Hiss”…

In the 1970s, a cassette tape manufacturer asked listeners, “Is it live, or is it Memorex?” Forty years later, watchers of the stock market “tape” find themselves asking, “Is it real, or is it QE?”

10-Year: Taper the Taper—Upside Limited

If interest rates keep going higher from here, we would run the risk of derailing a still-fragile recovery. As long as the Fed tapering uncertainty exists, we expect higher volatility on the 10-year yield to persist in the mean time.

Timing The “Taper”

The new debate over the QE “taper” erupted at the same time that a long-reliable Fed-tracking tool is telling us it’s time to ease.

The Weakening Yen — Too Far Too Fast

We are highly skeptical “Abenomics” can produce different results this time.

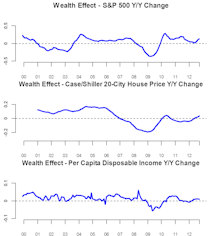

Wealth Effects: Housing Likely To Be The Bright Spot

The stock market wealth effect has been direct and pronounced. But it’s been wearing off, with the subsequent rally after each Fed stimulus weaker than the previous one.

Bernanke’s Bad Timing

We can’t imagine what good could come from Ben Bernanke’s September 13th decision to resume money printing. What is the Fed going to do if another risk event hits and the S&P goes down 15-20%? Pray?

Gold: Twelve Years And Going Strong

A textbook, commodity-like top in gold would be a panicky, spiky event that would take the metal well above $2000.

Market Dynamics: 2012 Sector Performance; Leverage Pays

In our framework, Health Care is the number one performer year-to-date by almost five percentage points.

QE3 Is Ill-timed And Should’ve Been Saved For A Greater Risk Event

What is the Fed going to do if another risk event hits and the S&P goes down 15-20%? Pray?

Tuning Up The Printing Presses?

What were QE2 and Operation Twist intended for if not to save Europe?

Risk Aversion Index Says “Wait And See”

The Monthly Risk Aversion Index edged down slightly in June, pausing for a clearer direction. The biggest contributors of risk are commodities and credit spreads.

The Impact Of Quantitative Easing On Style Factors

Chun Wang examines QE I & II in Japan, along with the initial QE in the U.S., to see how various quantitative factors have reacted in the past. While some factors may prove effective, the main difference between these past QE experience and the latest round is the macro conditions of the market.