Quality Factors

Profiting From Mighty Mites

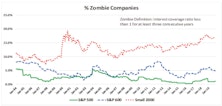

One of the signature traits of the U.S. small cap market is the prevalence of money losing companies. A recent tally indicated that prior to Covid, 38% of small caps were reporting trailing year losses despite the widespread economic strength of 2019.

Preview: The Importance Of Quality In Small Caps

One of the signature traits of the U.S. small cap market is the prevalence of money-losing companies. Our recent tally indicates that even prior to COVID-19, 38% of small caps were reporting trailing year losses despite the widespread economic strength of 2019.

Small Cap Quality Check

December’s Of Special Interest provided a recap of our Asset Allocation team’s view of small cap equities, suggesting that small caps had underperformed and reached a valuation discount that made them an interesting contrarian value proposition. Several clients responded with follow-up questions, wondering if the discount valuation of small caps was offset by their typically weaker business models.

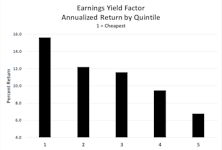

Factor Frontiers And Investing To The Max

Quantitative investing has taken the industry by storm over the last decade, and smart beta ETFs are pulling in billions of dollars as investors and advisors gravitate to this portfolio management technique.

Incongruities In High Quality

Quality is one of the most popular and successful of the equity market’s quant factors. It is intuitively appealing and serves as a useful defensive strategy in falling markets. Low Volatility and Dividend Growth are also defensive factors, while Momentum and High Beta are viewed as aggressive or bullish factors. These offsetting behaviors would seem to make for excellent diversification opportunities in equity portfolios, and for the most part, that is true.

Incongruities In High Quality

Quality is one of the most popular and successful of the smart beta factors. It is intuitively appealing and serves as a useful defensive strategy in market drawdowns.

Time To Hide In Quality?

Although both High Quality and Low Quality stocks suffered in the last two months’ market turmoil, we are not surprised to see that, on a relative basis, High Quality stocks outperformed Low Quality.