Real Estate Investment Trusts

Evaluating Real Estate Investment Trusts

In mid-2013 we developed a multi-factor model to select individual REITs, figuring that we could exploit an area of the market that is uncrowded from a factor and quantitative standpoint. The results have been outstanding, with the buy-rated securities outperforming the sell-rated securities by 45% since the model went live.

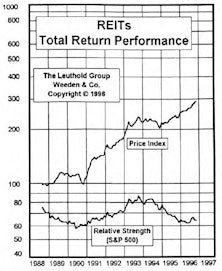

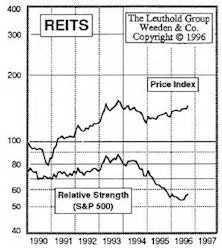

REITS Rally

Real Estate Investment Trusts and Insurance Brokers were this week's best groups. Tech Hw Stor & Periph and Oil & Gas Refining & Marketing were this week's worst groups.

Tactically Increasing REIT Exposure in Conventional Portfolio

REITs continually ranked this year among Most Attractive. After tactical additions, 15% now invested in REITs. Interest in these real estate proxies is definitely increasing, by both institutional and individual investors.

REITs: Building Upon Our Foundation

Conventional Portfolio boosting REIT holdings above the 8-10% core position. New purchases increase REITs to 12% of total assets. Increase viewed as tactical move, NOT an upward revision in core position.

Real Estate Segmented As Separate Asset Class

REITs removed from equity portfolio and now occupy separate real estate asset class. High equity valuations and moderate upside bond potential make real estate an appealing long term play.

Something To Buy Now

Observations and opinions on REITs as well as highlights from a recent institutional investor REIT forum.

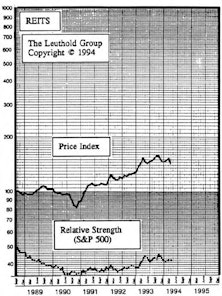

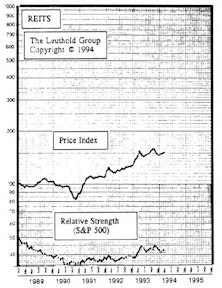

Building a Position in REITs

REITs being added to Conventional and Unconventional Portfolios. Expect total returns here to be in excess of 10% annually. REITs are also expected to act as a defensive holding in a down market.