Federal Debt/Deficit

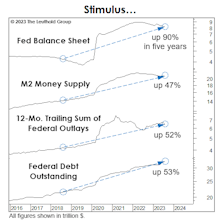

Has The Tsunami Of Stimulus Been Worth It?

Federal outlays, federal debt, and M2 have each jumped ~50% in five years, while the Fed’s balance sheet soared by 90%. The “reward”: Real GDP cumulative growth per capita of 1.6% per year (a good chunk of which will be reversed during a recession).

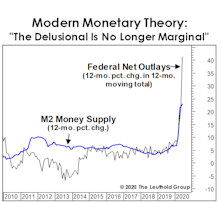

Fiscal “Juice?”

Not to pick a fight with Keynesians (or other economists), but we’re reluctant to label the explosion in the federal deficit as unequivocally “stimulative.” Some factors behind the increase probably do boost the economy, but others simply rob Peter to pay Paul.

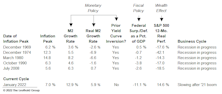

What “Causes” Inflation To Decline?

Last year’s consensus view that inflation would prove “transitory” missed the mark. There’s no reason for shame; inflation forecasting hadn’t been a required investment skill for the previous 30 years.

Fat Profit Margins? Thank Your Grandkids!

Future generations are now footing the bill, not only for today’s entitlement recipients, but for record corporate profits as well! (Consider a gift of QQQ shares to help them pay for it all.)

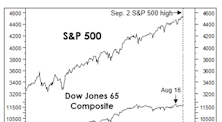

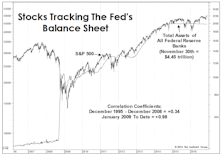

The Stock Market IS A “Fundamental”

The impact of U.S. stock-market “hegemony” extends far beyond currency markets. We believe the mania has progressed to the point where the stock market itself will shape the intermediate-term and even long-term fortunes of the U.S. economy more than it ever has before.

Why The Fed Is Hog-Tied

We’ve long considered ourselves lucky to have escaped from our graduate-economics program after only a year. Among the few nuggets we managed to retain was the startling conclusion to a paper written by a famed department professor asking, “Do Large Deficits Produce High Interest Rates?”

Measuring The Cost Of “Free”

The S&P 500 and NASDAQ have lately traded as if the hybrid “Fed/Treasury put” entails no cost at all. But dollar alternatives—like forex, precious metals, and crypto-currencies—are saying, “Not so fast!”

A Bear Market In Price, But Not Time

We have a hard time accepting that the excesses associated with an eleven-year bull market and expansion can be fully expunged in 27 trading days, no matter how ugly those days were… keep some powder dry!

Real Rates and the Federal Deficit

The real short-term interest rate shows how inappropriately-loose monetary policy has remained in the face of a steady economic expansion.

Real Rates And The Federal Deficit

We previously mentioned the increasing focus on the real short-term interest rate as an important measure of the Fed’s policy stance. In truth, we wish the Fed had paid more attention to this measure during this cycle.

Don’t Look Now, But...

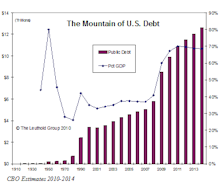

We recognize it’s uncultured to discuss federal debt and deficits during a multi-year bull market, but in economics and investing it frequently pays to worry when others don’t, and to stop worrying when others do.

Policymakers’ Shell Game

We considered the launch of the QE tapering program in January 2014 as the formal onset of the Fed’s tightening campaign, and that view seemed to be on the mark when High Yield bonds, and then stocks, unraveled over the next couple of years—although the final losses in the DJIA and S&P 500 fell short of what we expected.

“Just Another” Soft Patch

MTI studies of market values, investor psychology and price action have (so far) overwhelmed the economic “elephants in the room.” A few thoughts on those elephants.

Longer Term Concerns About U.S. Debt And Deficit

$4.8 trillion of the additional $9 trillion in debt that Uncle Sam is expected to incur over the next decade is interest obligation.

Longer Term Concerns About U.S. Debt And Deficit

More than one-half of the U.S. government’s additional $9 trillion in debt expected over the next ten years is projected to be interest. This is a frightening proposition.

The Bond Bubble Is Beginning To Deflate… Is The Cheap Money Era Ending?

The bond bubble is deflating, as investors demand higher yields to compensate for expected rising inflation and the U.S. mountain of debt.

The Bond Bubble Is Beginning To Deflate… Is The Cheap Money Era Ending?

We raised most of our twelve month yield targets this month, based on higher inflation expectations and U.S. debt concerns. Extremely low yields at the short end of the curve are the result of a stimulative Fed policy. Rising yields at the long end of the curve reflect rising inflation expectations.

Is The Bond Bubble Beginning To Deflate?

The bond bubble could be deflating, as investors demand higher yields to compensate for expected rising inflation and the U.S. mountain of debt.

Is The Bond Bubble Beginning To Deflate?

Bond bubble continues to inflate, much like money pouring into tech stocks at the height of the internet bubble.

Longer Term Concerns About U.S. Debt And Deficit

The kneejerk reaction to worries about excessive sovereign debt has been to bail out of the European sovereign debt and pile into U.S. sovereign debt. Unless the U.S. can get its own fiscal act together, we may face this same panic reaction farther down the road.

Are We In A Bond Bubble?

Bond bubble continues to inflate, much like money pouring into tech stocks at the height of the internet bubble.

Longer Term Concerns About U.S. Debt And Deficit

The kneejerk reaction to worries about excessive sovereign debt has been to bail out of the European sovereign debt and pile into U.S. sovereign debt.

Longer Term Concerns About U.S. Debt And Deficit

A mountain of new debt, a balloon of short term borrowing due near term, and the likelihood of higher interest rates are big hurdles.

Longer Term Concerns About U.S. Debt And Deficit

A mountain of new debt, a balloon of short term borrowing due near term, and the likelihood of higher interest rates are big hurdles. Moody’s says U.S. debt could test its AAA rating.

Longer Term Concerns About U.S. Debt And Deficit

A mountain of new debt, a balloon of short term borrowing due near term, and the likelihood of higher interest rates are big hurdles. Moody’s says U.S. debt could test its AAA rating.

Longer Term Concerns About U.S. Debt And Deficit

A mountain of new debt, a balloon of short term borrowing due near term, and the likelihood of higher interest rates are big hurdles. Moody’s says U.S. debt could test its AAA rating.

Longer Term Concerns About U.S. Debt And Deficit

We continue to have longer term concerns about U.S. debt and deficit. The mountain of debt is building and interest expense rising.

Longer Term Concerns About U.S. Debt And Deficit

Jim Floyd’s analysis of the interest costs facing the U.S. due to the soaring budget deficits.

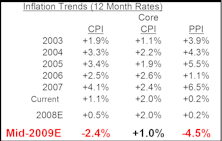

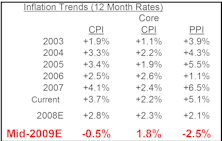

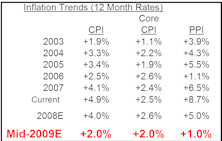

Fall Into Deflationary Territory Should Be Short Lived

Compared against very deflationary readings in the second half of 2008, PPI could finish 2009 up +2.0%. The worst of the commodity price downdraft should be behind us.

Decline Into Deflationary Territory Could Be Short Lived

2008 was a deflationary year for the PPI (–1.2%). 2001 was the last calendar year with deflation (-1.8%), and it was also a recession year.

Recent CPI and PPI Readings Declined By Largest Percentages In Over 60 Years

Currently declining energy and other commodity prices are producing some significant “down” months for CPI and PPI.

Outlook: Weak Economy, Inflation Decelerating

The consumer is in the worst shape that we can remember. September job loss was the highest in five years.

Outlook: Weak Economy, Inflation Decelerating

Revised Q4 real GDP confirms what we’ve been saying for quite some time...the U.S. economy began contracting in Q4 2007.

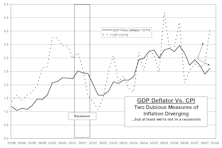

Inflation Understated Not Overstated

There is political pressure to keep inflation low, minimizing COLA (cost of living adjustments) and Social Security costs. Low inflation also helps to keep interest rates down, which keeps government interest payments as low as possible.

Current Stock Market Strategy

Market has so far performed pretty much as expected. Major Trend still Negative, but recent improvement is surprising. Bear market could be winding down.

Deficit Watch...Outlook Worsening

The U.S. economy is slowing and probably fell into recession in Q4 2007

Worth Noting???

What follows are my personal observations and opinions. I am an anti-inflation fiscal conservative and I know some would add “curmudgeon” to this description.

Jobs/Consumer Data Flashing Recessionary Signals

Optimists have continuously cited low unemployment and the ever resilient U.S. consumer as two “pillars of strength” that will help keep the economy afloat. It has become considerably more difficult to make this case in recent months, as jobs and spending data have weakened to levels associated with recessions.

U.S. Economy Skirts Recession In Q4, Or Does It?

It now appears that the downward bias in inflationary pressures suggested by the CPI data is tame compared to the GDP Deflator. And if this is true, investors may be operating under a false sense of security that economic growth remains positive (albeit ever so slight).

2008: Less Than Great

Yes, it is thermal pollution time again. It’s the new year when prognosticators and investment pundits produce large volumes of hot air, probably contributing to global warming.