Economy

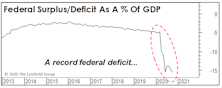

Can The Treasury Afford A Recessionary Bear?

In recent years, stock market swings have become a more reliable predictor of tax receipts than the economy, itself. If both were to roll over, deficits in the “teens” as a share of GDP—and Fed efforts to deal with them—are unavoidable.

A Delayed Day Of Reckoning?

Today, the recession / no-recession call dominates daily market debate probably more than any time since the spring of 2008 (when the economy had been in recession for 4-5 months). We fully expect the U.S. economy to roll over in the next several months.

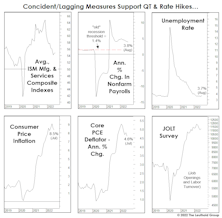

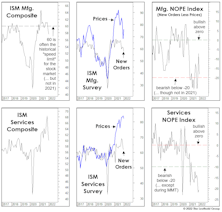

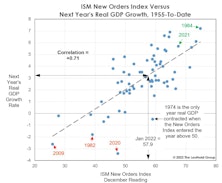

ISM: Down, But Not Out

Early evidence shows the recent banking calamity knocked down already-fragile measures of confidence and activity, as exhibited by the ISM Manufacturing Composite posting a fifth-consecutive reading below 50.

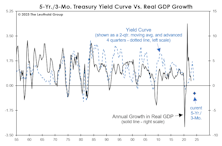

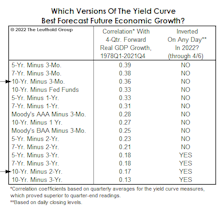

The Yield Curve Meets Microsoft Excel

To our surprise, the measure that most closely correlated with real-GDP growth on a one-year time horizon is the rarely mentioned Treasury spread for the 5-Yr./3-Mo.

Which Yield Curve?

Last month’s inversion in the 10-Yr./3-Mo. Treasury spread further tilts an already lopsided scale in favor of a U.S. recession in 2023. That spread has been considered the gold standard from an economic forecasting perspective, and is the basis for the New York Fed’s Recession Probability estimate (which, by the way, should break above its critical 35% threshold when it’s published later this month.)

Interrupting The Recession Debate With A Reminder Of How Hot The Economy Is

“Money illusion” continues to complicate analysis of the economy and financial markets. It might be a time when age and experience will actually prove helpful: Only investors who are 65 or older have experienced gaps between “nominal” and “real” data as wide as today’s.

Tightening Into A Slowdown: Month Eight

We think the U.S. economy will slip into recession sometime in the next year, but the level of “excess savings” provided by pandemic aid renders the already difficult task of timing more elusive than ever.

Tightening Into A Slowdown: Month Seven

An economy can slow to a standstill on a “real” basis while growing rapidly in nominal terms; it happens in emerging economies all the time. But this dichotomous condition now afflicts most of the developed world.

No Rest For The Weary

If there’s a polar opposite to “Goldilocks,” this must be it. Not too hot and not too cold? What about both? Job growth and inflation are hot enough to force the Fed to follow through on its hawkish promises. But the leading indicators continue to warn us of oncoming cold. The odds that the porridge settles at the right temperature, without an intervening recession, look longer by the day.

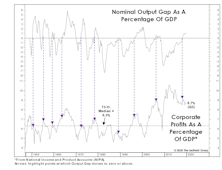

“Gapping” Lower?

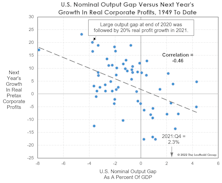

NIPA’s “all-economy” profit margin declined a bit in Q4—which typically peaks before SPX profits—and that falloff coincided with the economy officially reaching full employment, based on the CBO’s Nominal GDP Output Gap. When the Output Gap has flipped positive (like in Q4), corporate profit margins usually come under immediate pressure.

The Terrible “Two-Year”

In a simple test of 15 yield-curve variants, we found that the 2s10s spread ranks second to last, based on its correlation with one-year-forward real-GDP growth since 1978. The three best measures employed the 3-month bill as the “short” rate. The spread between the 5-year note and 3-month bill showed the strongest correlation with subsequent economic growth.

Speed Trap Ahead?

In San Francisco, thefts of less than $950 have been decriminalized, while in Minneapolis, police are so beleaguered that car thefts not involving injury are ignored. Is it any wonder that the economy felt free to violate its usual stock market “speed limits” throughout much of 2021?

“Plotting” The Course For 2022

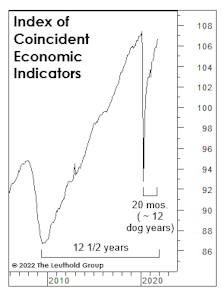

The economic expansion officially entered its 22nd month in February. In dog years, that translates to an age of 13—the same age the recovery might have reached this July if not for the COVID disruption. The late-cycle characteristics displayed by a recovery that’s statistically so young dissuade us from issuing a high-conviction forecast for 2022.

Carbon-Dating The Recovery

If January is the 21st month of the recovery, then time has elapsed in “dog years.” And that might put this “canine” recovery at around 12 years—just shy of where we might be had COVID never occurred!

No Bark, No Bite?

If NBER is correct that a new economic expansion began in mid-2020, then this cycle is unfolding in “dog years.” After limiting between-meal snacks earlier this year, champion-breeder Jay Powell has informed his pack of canines that their portions will also be reduced as of later this month.

The Stock Market IS A “Fundamental”

The impact of U.S. stock-market “hegemony” extends far beyond currency markets. We believe the mania has progressed to the point where the stock market itself will shape the intermediate-term and even long-term fortunes of the U.S. economy more than it ever has before.

How Much Inflation Is Too Much? It’s A Moving Target

In the latest Green Book, we noted that Producer Price Inflation does not usually become a challenge for the stock market until its annual rate breaks above 4.0%. The day that comment was published, the year-over-year gain in the March PPI for Finished Goods spiked to 6.0%, thanks mostly to the well-celebrated COVID-19 anniversary-effect.

A Great Profit Quarter Was “In The Bag”

Economists marveled at the rebound in third-quarter NIPA corporate profits to new all-time highs, but it’s just “bean bag” economics from more than a century ago.

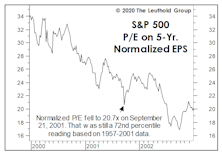

Does An Economic Rebound “Inoculate” The Stock Market?

The 2020 decline exhibits a strong resemblance to the “incomplete” bear market of March 2000-September 2001—in that neither decline sufficiently deflated the extreme valuations of the preceding bull, and each was followed by an immediate rebound in reliable valuation measures to top decile levels.

A Cross-Asset Dash For Cash

March’s mad dash for cash didn’t stop with rates/credit/FX markets. Among equities, there was also a strong preference for cash liquidity. The market rewarded companies that had strong cash positions and punished those without—which explains why traditionally defensive styles actually underperformed.

Over-Stimulated?

We can’t count the number of times in the last week we’ve heard analysts worry about “what the Fed might know that we don’t.” In the words of John McEnroe, “You cannot be serious!”

Are Earnings Set To “Gap” Higher?

We are troubled that the bullish optimism has spilled over into the 2020 estimates for S&P 500 earnings. Zero growth in 2020 is probably not a bad guess for NIPA figures, but S&P numbers don’t always follow suit.

Waiting For The Stimulus To Trickle Down...

Last year the Federal Reserve dumped historic stimulus onto a full-employment economy and an already richly-valued stock market. The stock market obviously loved it.

A Small Cap Strategy Session

Leuthold’s research team has recently flagged a number of items that suggest it may be time to consider small cap stocks. This asset class has been showing signs of life and the decision to overweight small caps is starting to seem relevant – and perhaps nicely profitable - again.

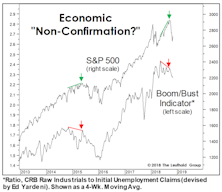

Are Stocks And The Economy Disconnected?

The consensus among market pundits is that a U.S. recession will be averted and, as a consequence, domestic stocks remain the best game in town.

How Will It Be Remembered?

A way to gain perspective on the present is by trying to view it from the future. Ask yourself, “What are the signs of impending decline, now ignored by investors, that will one day be memorialized by the same investors as the most obvious in retrospect?”

We’re All Economists Now!

It’s now been more than 19 months since global stocks peaked on January 26th, 2018. Those lucky enough to have been invested solely in the S&P 500 and to have held on for the volatile ride have a 3.7% gain to show for it. Nice going.

Is A Strengthening Dollar A Form Of Policy Tightening?

Executive summary (for those leaving early for the holiday weekend): No.

We’ve found no reliable relationship between swings in the U.S. Dollar and subsequent variations in U.S. economic growth.

Recession Evidence: How Much Is Enough?

Over a 12-month horizon, we now believe a U.S. recession is very likely, but aren’t confident enough to make the call when the forecast window is cut in half. Second-half stock returns could be decent if the business-cycle peak is still a year away. Then again, there’s peril in waiting for “too much” confirmation of recession.

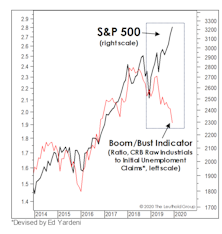

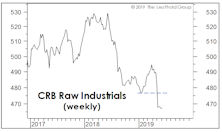

Bust To Boom, And Back Again

Last month, we observed that crude oil was the only item propping up broad-based commodity indexes, and that something was bound to give with the U.S. dollar pushing to new highs.

Where Are Yields Headed? Look In The Mirror!

Many economists believe U.S. economic growth will reaccelerate in the second half, sending 10-year Treasury bond yields back above 3% late in the year. A forecasting technique with an excellent record, however, suggests the return to 3% won’t occur until late next decade!

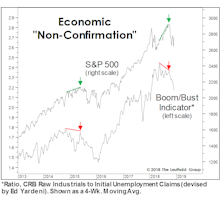

Divergence, Danger, And Delusion

The U.S. economy and blue chips have shrugged off the risk of the worst trade war since 1930’s Smoot-Hawley Act, while comparatively few stocks on either the NASDAQ or the NYSE have broken out to 52-week highs. There’s also the troubling talk of the Fed having tamed “the cycle.” Should investors bet on a potentially wild (but narrower) final melt-up over the next 6-12 months? We don’t like the odds.

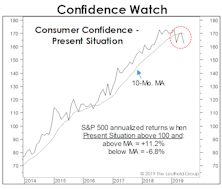

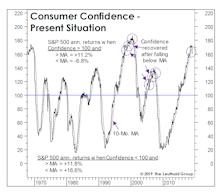

A Confidence Game

Several consumer confidence gauges plunged in the wake of the Q4 market decline (as expected), and then rebounded in a lagged response to the stock market recovery (again, as expected). But March saw the largest one-month drop in consumers’ assessment of their “Present Situation” since 2008.

Partying Like It’s 1998-99

We thought Jerome Powell’s “Christmas Capitulation” would be tough to beat, but he accomplished that two days ago with what could be called his “Spring Surrender.” That, in turn, has rekindled hopes of a stock market melt-up along the lines of 1998-99, which, as old-timers will remember, followed a late-cycle correction that was nearly identical to the one seen last year.

Watch What They Do, Not What They Say

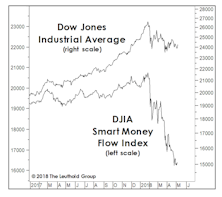

While the celebration over Jerome Powell’s “Christmas Capitulation” lingered throughout February, we’re still awaiting signs the capitulation consisted of anything more than words.

Economic Stocking Stuffers

While the monetary and liquidity backdrop has deteriorated all year, the shorter-term economic evidence has remained mixed.

Too Soon To Expect Economic Weakness?

We believe stocks have begun to discount a major inflection point in the economy and corporate profits for 2019 and 2020.

Stock Market Observations

Throughout the spring and summer, the market could alternatively be characterized as “divergent” or “disjointed”—but until very recently it could not be considered “distributive.” Now, Mid and Small Caps have hit a short-term air pocket and breadth figures were exceptionally poor at September’s scattered highs in the DJIA and S&P 500.

The Bulls And Bears Agree!

Yes, bulls and bears now hold their respective positions for the same reason—i.e., the U.S. economy is exceptionally strong. The stock market is accommodating this rare bipartisanship with sufficient reason to support either position.

The Market Told You So

First quarter profits have been terrific, and this quarter’s will be too. Enjoy them, but remember that the market “paid” you for them many months ago. Don’t submit another invoice…

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)